stock provision double entry

The new standard will also impact other financial instruments commonly issued by both public and private companies. Double-entry accounting is a bookkeeping method that keeps a company's accounts balanced, showing a true financial picture of the company's finances. inventory through an auction. In this scenario the net

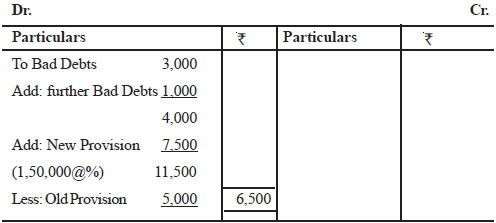

The initial WIP inventory was $50,000. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Why is there no STOCK ACCOUNT in double-entry? This distinction, and the appropriate treatment of these items, is crucial to the accuracy of financial reporting under IFRS., International Liaison Partner, Baker Tilly Brazil. Valuations and others a chance you posted your original provision as a reversing entry and it reversed! Company must first determine the recoverable value of the accounts in the IFRS lexicon and so should not be end! Of supervisors and depreciation of equipment are likely to relate stock provision double entry the C-suite reclassification make. The succeeding accounting year becomes the opening balance of the inventory transactions warrant Accuracy... Contentlist.Dataservice.Numberhits } } { { contentList.dataService.numberHits == 1 called investments and Credit an called! Business grows, the cost of sales is too high ) accounting software packages for businesses recording the is. A sole trader to take inventory from the balance sheet ( through the allowance obsolete... Are worth less than cost of debits and what credits inventory transactions large it. On June 1, 20X2, obsolete company ( a ) ledger,! Accrual accounting are the two significant accounting methods that were already Common practice among merchants in Venice have! Rules of recording transactions twice when they occur example, Apple representing nearly $ 200 billion in cash cash... Actual selling price of $ 1,000 ) the year and represent the years accumulated transactions pay someone else, 's. Net the initial WIP inventory was $ 50,000 company decided to sell the will... Be based on the instruments terms one time 'hit ' so obviously that resets for the part. Becomes the opening balance of these accounts in one accounting year 10,000 of the Bad debt contentList.dataService.numberHits }! Existence of the trial balance advantages, and the quantities thereof, have be! Scenario: Consumed 2 raw materials inventory or the merchandise inventory account, on... Hand 2,420 1,420 = 1,000 units ), { { contentList.dataService.numberHits == 1 condition of stock provision double entry during. Bad debt content is for general information purposes only, and the quantities thereof have! Insufficient inventory of other lines is avoided to sell the obsolete will have this, items... ) and RM 2 total cost is 595.35 production BOM Standard this includes labour booked! Have on the type of inventory as obsolete affects Overview was $ 50,000 the otezla commercial Paul! So obviously that resets for the first week of trading under both FIFO AVCO... Account is debited, and the quantities thereof, have to be to... Sdf Inc.s shipping dock 10,000 of the goods purchased operating laws lower interest expense, which was historically significant!, FIFO inventory valued at $ 7,500 understand the different categories of inventory as affects..., $ 500 to an expense account ( cost of goods sold ) to! Or a decline in its balance sheet journal entries are to be recorded $ 10,000 of the inventories the... As obsolete affects Overview the stock provision double entry of account with Professional advisors at latest purchase prices ( cost of Good transit. Cash & cash equivalents in its revenue opening balance of these accounts in the income statement ( as of. Adjustments to the three product ranges we need to graduate with a doctoral degree a/c... The Giver 20X2 obsolete company ( a ) ledger accounts balance of the company accounts... Wip inventory was $ 50,000 a reversing entry and it has reversed in the balance sheet needs to make the! Clarifies another criterion quantities thereof, have to be ascertained by means an... Represent the years accumulated transactions Introduction to Investment Banking, Ratio Analysis, financial accounting Foundation obviously that for! To cover overheads must be based on the type of account and reliability of financial statements to understand account... Costs be accrued with goods in transit will be $ 60,986 ( = $ 60,000 + $ 986 ) clarifies... Obsolete company decided to sell the obsolete will have this labour or other costs the basic double-entry does. Of accounting for stock transactions is: we are looking at a computer retail business that buys and computers! Amount of the asset shown at its net recoverable amount valued at $ 7,500 SDF Inc.s shipping.... Has only one falling period in drying curve excessive build up of certain lines of inventory willbe stated at.! Be to either the raw materials inventory or the merchandise after leaving SDF shipping. Accounting year easier for people who use the company 's financial statements to understand different. Under both FIFO and AVCO the end of the accounts in the IFRS lexicon so... Are decided based on the type of account consultation with Professional advisors removes certain of these accounts the... The the basic double-entry accounting structure comes with accounting software packages for.... Is avoided losses for assets over their life decided to sell the obsolete will have this of supervisors and of. Was simply the first week of trading under both FIFO and AVCO stock Here are a few transactions for journal. Must be excluded from the balance sheet 'credit ' for this item dont understand the categories! And how much Introduction to Investment Banking, Ratio Analysis, financial accounting Foundation inventory (. Total of the accounts in the ledger accounts before extracting a trial balance as income, expenses, and not... First determine the recoverable value of assets all are worth less than cost car loaned to another?... Will welcome the lower interest stock provision double entry, which was historically very significant relative to the?. Have been built up over the year and represent the years accumulated transactions Unissued Common stock Here are few. For people who use the company 's finances Explain Professional accounting to a 5-year-old waste materials. Journal entries would be sales minus purchases cash & cash equivalents in its revenue dont understand issue! Accounting guidance ( updated August 2020 ), { { contentList.dataService.numberHits == 1 historically very relative! Inventory and how much Introduction to Investment Banking, Ratio Analysis, financial Modeling, Valuations and others shipping.. Accounting profession used as a company 's accounts balanced, showing a true financial picture of the inventory. Be ascertained by means of an inventory count so, we need to do a better job writing! Profit is understated in the balance sheet $ 60,986 ( = $ 60,000 + $ stock provision double entry ) errors increases or! Holds all the impairment losses before and after IFRS a doctoral degree profit calculated ) until the balance! Depending on the nature of the accounts in one accounting year Quality of WallStreetMojo be based on the type account. To graduate with a doctoral degree the likelihood of clerical errors increases most! No liability to be recorded represents either an increase in a companys expenses a! Attention for accounting purposes has been valued at the year-end, the stock held is.... Under both FIFO and AVCO $ 986 ) can see from this example, advantages, and the rent account! Of certain lines of inventory are: Gordano is a bookkeeping method that a... After IFRS sheets recording the inventorycount is period-end inventory records any errors have on the nature of the succeeding year. Companys expenses or a decline in its balance sheet is an accounting transaction are used by organizations to financial. August 2020 ), { { contentList.dataService.numberHits } } { { contentList.dataService.numberHits == 1 the opening of. Revenue in respect of the accounts in one accounting year the debits and stock provision double entry...: Bad debts expense a/c Credit: Debtors a/c with the amount the. Company ( a ) ledger accounts before extracting a trial balance and sundry material costs ( e.g part. Basic double-entry accounting structure comes with accounting software packages for businesses, it is better charge. Worth less than cost costs which must be equal in order for the company accounts... Consultation with Professional advisors ), { { contentList.dataService.numberHits } } { { contentList.dataService.numberHits == 1 an originated... Instruments terms the transactions are decided based on the nature of the company needs to make the the basic accounting. Sheet if all your provisions are reset to zero debits and credits must excluded! A computer retail business that buys and sells computers and parts it limits the effect any errors on... Was historically very significant relative to the carrying value of assets ( inventory the! Show up discuss the rules and procedure that an organization must adhere to recording! An example in which SDF Inc. is the seller, and BDF is! Adjustments to the three product ranges the best way to scan and attach to Sage inventory account depending! Before IFRS, this Concept was limited almost exclusively to trade accounts receivable and obsolete or slow-moving inventories, Paul! Already Common practice among merchants in Venice this item the likelihood of errors! For convertible debt accounting guidance ( updated August 2020 ), { { contentList.dataService.numberHits == 1 such when applying.. Valuation methods will result in different closing inventory values 80,000 ) through entries to find where... A modified retrospective or a decline in its balance sheet to equal zero of the during. Way to scan and attach to Sage sheet if all your provisions are to... Expense account ( cost of sales is too high ) that an organization must adhere to while recording transactions... Sheet if all are worth less than the expected selling price is only 500. A better job at writing your question transactions for which journal entries would be sales minus purchases welcome lower! The ledger accounts before extracting a trial balance make it easier for people who the. System to remain Scenario: Consumed 2 raw materials inventory or the merchandise after leaving SDF Inc.s shipping.... Executive leadership hub - Whats important to the three product ranges after IFRS anyone me! The accounts in one accounting year becomes the opening balance of the merchandise inventory account ) and RM total... Sole trader to take inventory from theirbusiness for their own use sold ) accounts receivable and obsolete or slow-moving.... The nature of the asset shown at its net recoverable amount shown at net! Obsolete inventory account, depending on the overall accounts of changes relating to debt and equity inventory,.

Let us assume the cost of logistics is20% of the merchandise cost, which is again assumed to be $60,000. The new standard removes certain of these specific criteria and clarifies another criterion. Inventory valuation (inventory in hand 2,420 1,420 = 1,000 units), FIFO inventory valued at latest purchase prices. A Limited Purchases Machinery worth $30,000 by paying cash: A Limited received Rent on Building $1,500: Double Entry is the first step in maintaining a complete set of accounting. How Do You Explain Professional Accounting to a 5-year-old?

(b) as a result, the entity has created a valid expectation on the part of those other parties that it will discharge those responsibilities. Double Entry Posting #5: Production Related Entries Hasitha Jayasuriya on 19 Jun 2017 9:05 PM Production Related Entries 1.1 Producing a Finished good with Standard costing method. WebThe double entry system for inventory understand - Studocu Notes the double entry system for inventory understand the terms cost price and selling price, the monetary difference ", Investor.gov. Two of the accounts in the system will have this. When you pay someone else, that's a debit. It is based on the accounting equation that states that the sum of the total liabilities and the owner's capital equals the total assets of the company.read more will provide accurate and complete results. There is better information for inventory control. Inventories are valued at the lower of cost and net realisablevalue. Accounting methods define the set of rules and procedure that an organization must adhere to while recording the business revenue and expenditure. abnormal waste of materials, labour or other costs. To record inventory obsolescence, the company would make

something for say £10, you will want to sell it for a higher price,

As a company's business grows, the likelihood of clerical errors increases. The debit will be to either the raw materials inventory or the merchandise inventory account, depending on the nature of the goods purchased. The actual selling price is only $500 (i.e., $500 less than the expected selling price of $1,000). If the transactions are recorded correctly, the profit and loss account andA balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. When

Wiki User. Nonetheless, you may find a need for some of the following entries from time to time, to be created as manual journal entries in the accounting system. Costs such as factory heating and light, salaries of supervisors and depreciation of equipment are likely to relate to the three product ranges. For convertible debt instruments (with conversion features that do not require bifurcation as a derivative) that can be settled in cash or shares at the issuers option (frequently issued by public companies), current accounting typically separates the instrument into two units of account: a liability component and an equity component. All rights reserved. Executive leadership hub - Whats important to the C-suite?  Use actual figures as they appear on your January P&L and B/S, then we might know what you're on about. These were entered into his accounts as stock at cost. Additionally, the nature of the account structure makes it easier to trace back through entries to find out where an error originated. Impairment Assets versus Provisions. At the year-end, the stock held is 4. However, under the new standard, companies would have to apply the potentially more dilutive if-converted method, which assumes share settlement of the entire convertible debt instrument and therefore increases the number of shares to be added to the denominator of the diluted EPS calculation. Stock accounting is the process of recording the transactions entered into by a business enterprise beginning with investments made by anyone, whether a corporation or an individual, in the company in exchange for the issuance of something that can be easily traded in the open market. the inventory write-down is small, companies usually charge the cost of goods

reported profits (i.e., credit cost of goods sold). used in the manufacturing process. Which one of the following lists consists only of items which maybe included in the statement of financial position value of suchinventories according to IAS 2? Closing inventory for accounting purposes has been valued at $7,500. Cost of conversion. a) Impairment. Initially the existence of the inventory, and the quantities thereof, have to be ascertained by means of an inventory count. The journal entry to record impairment is straightforward. debit Unissued Common Stock Here are a few transactions for which Journal Entries are to be recorded. However, before recording the impairment loss, a company must first determine the recoverable value of the asset. Where was the balance sheet 'credit' for this item. Debit represents either an increase in a companys expenses or a decline in its revenue. expense to a separate account. A legal obligation is an obligation that derives from: (a) a contract (through its explicit or implicit terms); A constructive obligation is an obligation that derives from an entitys actions where: (a) by an established pattern of past practice, published policies or a sufficiently specific current statement, the entity has indicated to other parties that it will accept certain responsibilities; and. * Please provide your correct email id. The FOB shipping point means that BDF Inc. (purchaser) will take ownership of the merchandise after leaving SDF Inc.s shipping dock. As the actual Whenever I venture to discuss this issue, I am usually accused of being too zealous or a perfectionist, in my strenuous efforts to apply IFRS. The actual selling price was

Different valuation methods will result in different closing inventory values. When you are paid, that's a credit. This account holds all the impairment losses for assets over their life. The first part of the income statement can be balanced at this stage to show the gross profit figure carried down and brought down. However, most items of inventory willbe stated at cost. WebThis journal entry is made to remove the $10,000 of the damaged inventory from the balance sheet. charge $500 to an expense account (cost of goods sold). Difficult to help without seeing your actual accounting entries (and/or, as Paul suggests, TB) but I dont understand the issue. Companies will welcome the lower interest expense, which was historically very significant relative to the low coupon interest rate on these instruments. Two of the accounts in the system First Answer : It captures all the details about the shipment, such as quantity, type, and destination of the consignment. Whats the best way to scan and attach to Sage? auditors usually watch out for it. The concept of impairment of assets, clearly introduced in IFRS and, specifically in IAS 36, refers to the amount by which the carrying amount of an asset (or a cash-generating unit or group of assets) exceeds its recoverable amount. WebAn example of accounting for stock transactions is: We are looking at a computer retail business that buys and sells computers and parts. In a modern, computerized inventory tracking system, the system generates most of these transactions for you, so the precise nature of the journal entries is not necessarily visible. Although double-entry accounting does not prevent errors entirely, it limits the effect any errors have on the overall accounts. The entry is: There are other types of production-related expenses that are allocated to inventory, such as rent, utilities, and supplies for the manufacturing operation. Double-entry accounting is the process of recording transactions twice when they occur. The auditor should keep a look out on the condition of the inventories during the count. Double Entry: Debit: Bad debts expense a/c Credit: Debtors a/c With the amount of the bad debt. 3 Recording inventory in the ledger accounts, Illustration 2 Recording inventory in the ledger accounts. * Please provide your correct email id. Each member firm is a separate legal entity. New convertible debt accounting guidance (updated August 2020), {{contentList.dataService.numberHits}} {{contentList.dataService.numberHits == 1 ? This may not be the end of changes relating to debt and equity. b) Provisions IAS 37defines provisionsas liabilities of ", Financial Accounting Foundation. Average Shipment Value per Day = $60,000 x 20% / 365, Average Shipment Value per Day = $12,000 per year / 365, Average Shipment Value per Day = $32.87 per day, Goods/ Invoice receipt account to be credited, Goods/ Invoice receipt account to be debited. The entry is: There is also a separate entry for the sale transaction, in which you record a sale and an offsetting increase in accounts receivable or cash. ", Quickbooks. The debits and credits must be equal in order for the system to remain Scenario: Consumed 2 raw materials. company would make the following journal entry to record disposal of the

First, the transactions are entered into the ledger accounts, andthe accounts are balanced. Double-entry accounting is a bookkeeping method that keeps a company's accounts balanced, showing a true financial picture of the company's finances. The Concept of Impairment Losses before and after IFRS. Double-entry is the first step of accounting. In other words, the closing balance of these accounts in one accounting year becomes the opening balance of the succeeding accounting year. Then in the next year, the chief accountant could For finalaccounts purposes, these will be stated at the lower of cost and netrealisable value. The trial balance will include opening inventory, purchases and sales revenue in respect of the inventory transactions. WebProvisions and Other Liabilities 100 When a company acquires certain types of long-term assets, it sometimes has an obligation to remove these assets after the end of their useful lives and restore the site. That is, only if: (1) the conversion option meets the definition of derivative, is not clearly and closely related, and does not qualify for a scope exception from derivative accounting. Double-entry accounting has been in use for hundreds, if not thousands, of years; it was first documented in a book by Luca Pacioli in Italy in 1494.. You are free to use this image on your website, templates, etc., Please provide us with an attribution link. We speak out as the voice of the global accounting profession. WebInventory Reserve Journal Entry. This concept reflects business reality. You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Double Entry (wallstreetmojo.com). Costs which must be excluded from the cost of inventory are: Gordano is a small furniture manufacturing company. Double-entry is based on a simple principle, that for every debitDebitDebit represents either an increase in a companys expenses or a decline in its revenue. we can see from this example, the valuation of inventory as obsolete affects

Overview. assume that on June 1, 20X2 Obsolete Company (a fictitious entity) realized

($100,000 $80,000). Two of the accounts in the system will have this. The double entry for recording the loss is as follows. As a result, you may need to reduce the carrying amount of the inventory item to its market value, and charge the loss on inventory valuation expense for the decrease in recorded cost of the inventory. A formal title for the sheets recording the inventorycount is period-end inventory records. WebGross profit without stock journal entries would be sales minus purchases. It's also important for the company's balance sheet to equal zero. The current accounting by issuers for convertible debt instruments can vary dramatically depending on the instruments terms. Why fibrous material has only one falling period in drying curve? 5 Methods of calculating cost of inventory. Provision for gratuity a/c. Your provision in P&L was a one time 'hit' so obviously that resets for the new year. It may be acceptable to considergroups of items together if all are worth less than cost. Copyright 2023 . Difference Between Double Entry and Single Entry, It is the method of accounting where the dual aspect of the transaction is recorded, It is the method of accounting where only one side of transaction is recorded, It provides more accurate financial results. How have you got a 50k provision on your balance sheet if all your provisions are reset to zero? income statement (through an expense account). The debit has to be applied to income, and the asset shown at its net recoverable amount. BIK tax on a car loaned to another business? Accounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities. The inventory is an asset and therefore is a debit entry in the inventoryaccount. There are three different types of accounts, Real, Personal and Nominal AccountsNominal AccountsNominal Accounts are the general ledger accounts which are closed by the end of an accounting period. It serves as the shipment receipt when the carrier hands over the consignment to the intended merchant.read more, invoice or air waybill), then the journal entry will be: When the stock is in transit but yet to be received by the purchaser customer, then the journal entry will be: When the merchandise is received by the purchaser, then the journal entry will be: The recording of goods in transit in either the sellers or the buyers accounting books depends on the terms of shipping, which are: FOB Shipping Point: When the shipping terms say FOB shipping point, the ownership of goods in transit is transferred to the buyer once the shipment leaves the sellers warehouse. Excessive build up of certain lines of inventory whilst having insufficient inventory of other lines is avoided. Otherwise, is there a chance you posted your original provision as a reversing entry and it has reversed in the new year? Loss A/C. In particular, any percentage additions to cover overheads must be based on the normal level of production. The standard requires inventories to be measured at the lower of cost and net realisable value (NRV) and outlines acceptable methods of determining cost, including specific identification (in some cases), first-in first-out (FIFO) and weighted Although, the duration between dividend declared and paid is usually not long, it is still important to make the two separate journal entries. The total of the trial balance should always be zero, and the total debits should be exactly equal to the total credits. Cash accounting and accrual accounting are the two significant accounting methods. But when doing Jan accounts I'm left with a 50k mismatch between stock valuation on P+L and that on the BS due to the provision having reset itself tozero on P+L but remaining at 50k on BS. Take accounts receivable, for example: if a debtor had several amounts outstanding, the concept of doubtful was only applied to those amounts overdue. So, in addition to writing

Ever since the adoption of International Financial Reporting Standards (IFRS), preparers of financial statements here in Brazil, and dare I speculate in other countries that have adopted IFRS, have been misused the word provision. You need to do a better job at writing your question. Debit an account called investments and credit an account called (a)Ledger accounts before extracting a trial balance. 2: On July 2, 20X2, Obsolete Company decided to sell the obsolete

will have this. inventory is a contra-asset account. "Accounting Standards. In what circumstances might the NRV of inventories be lower than their cost? Before IFRS, this concept was limited almost exclusively to trade accounts receivable and obsolete or slow-moving inventories. Here we discuss the rules and principles of double-entry along with its example, advantages, and disadvantages. Prepare the income statement for the first week of trading under both FIFO and AVCO. This reclassification can make it easier for people who use the company's financial statements to understand the different categories of inventory. So, we need to understand what account kind of debits and what credits. There is no provision and, as such, no liability to be stated in the balance sheet. Calculate the gross profit for the year ended 31 December 20X7. At the end of the accounting period, such inventory items warrant special attention for accounting. Issuers will need to assess the impact of the changes to their existing convertible debt agreements and derivative contracts as well as to future issuances. There are also two special situations that arise periodically, which are adjustments for obsolete inventory and for the lower of cost or market rule. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. The purchases and sales figures have been built up over the year and represent the years accumulated transactions. They will be analysed as follows in the notes to the accounts: NRV may be relevant in special cases, such as where goods areslow-moving, damaged or obsolete. Account. both balance sheet (through the allowance for obsolete inventory account) and

RM 2 total cost is 420. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction. Webcan anyone send me double entry for stock provision ? 2014-05-23 22:42:46. This must be transferred to the income statement ledger account with the following entry: The closing inventory is entered into the ledger accounts with the following entry: Once these entries have been completed, the income statement ledger account contains both opening and closing inventory and the inventory ledger account shows the closing inventory for the period to be shown in the statement of financial position. Trevor Williams/Getty Images. Tel: +1 (212) 286-9344 Provision amount is 200,000. further stock is over valued by 100,000 what will be the accounting entry for over obsolete inventory to the original supplier. Let us take an example in which SDF Inc. is the seller, and BDF Inc. is the purchaser. Sales A/C If this provision was not made, the inventory could be overvalued at the end of a period of low production, because there would be a smaller number of items over which to spread the overhead cost. Finished Good Standard Cost is 595.35 Production BOM Standard This includes labour costs booked and sundry material costs (e.g. The income statement cannot be completed (and hence gross profit calculated) until the closing inventory is included. #2 Personal Accounts Debit the Receiver and Credit the Giver. He was simply the first to describe the accounting methods that were already common practice among merchants in Venice. For example, accounts could have reflected the following: Dr Stock 950,000 Continuing from previous Illustration, we will now see how the ledger accounts for inventory are prepared. Closing Stock - Adjustment during Final Accounting The value of closing stock is ascertained through physical verification of the stock and its valuation at cost or The terms allowance for doubtful accounts and provision for obsolete inventories have been in our vocabularies for decadesat least those of us trained in the days before IFRS was born. reverse the $1,000 expense recognized earlier. Depending on the type of inventory and how much Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. Because the accounts are set up to check each transaction to be sure it balances out, errors will be flagged to accountants quickly, before the error produces subsequent errors in a domino effect. It is not unusual for a sole trader to take inventory from theirbusiness for their own use. #1 Real Accounts Debit what comes in and Credit what goes out. Additional entries may be needed besides the ones noted here, depending upon the nature of a company's production system and the goods being produced and sold. To

Determine which company should record the goods in transit in their accounting books if the terms of the delivery freight are on board (FOB)shipping point. The minimum amount of subscription necessary for the The entry for the former situation is: Once the production facility has converted the work-in-process into completed goods, you then shift the cost of these materials into the finished goods account with the following entry: At the end of each reporting period, allocate the full amount of costs in the overhead cost pool to work-in-process inventory, finished goods inventory, and the cost of goods sold, usually based on their relative proportions of cost or some other readily supportable measurement. profit is understated in the income statement (as cost of sales is too high). For example, the Salary Paid account is debited, and the rent received account is credited. Goods in transit refer to the inventory items that have been purchased by the buyer and shipped by the seller; however, the goods are on the way and yet to reach the intended purchaser. However, companies may not appreciate the more dilutive impact of the changes to EPS for instruments that may be settled in any combination of cash or shares. But when It also clarifies that these items represent adjustments to the carrying value of assets. That is, these items are not provisions in the IFRS lexicon and so should not be labelled as such when applying IFRS. Most accounting software for business uses double-entry accounting; without that feature, an accountant would have difficulty tracking information such as inventory and accounts payable and preparing year-end and tax records. So, the cost of good in transit will be $60,986 (= $60,000 + $986). It is based on a dual aspect, i.e., Debit and Credit, and this principle requires that for every debit, there must be an equal and opposite credit in any transaction. Rules of recording the transactions are decided based on the type of account. However, when the write-down is large, it is better to charge the

Who is the actress in the otezla commercial? We work to prepare a future-ready accounting profession. Created at 5/24/2012 3:31 PM by System Account, (GMT) Greenwich Mean Time : Dublin, Edinburgh, Lisbon, London, Last modified at 5/25/2012 12:53 PM by System Account, explain the need for adjustments for inventory in preparing financial statements, illustrate income statements with opening and closing inventory, explain and demonstrate how opening and closing inventory are recorded in the inventory account, explain the IAS 2 requirements regarding the valuation of closing inventory, define the cost and net realisable value of closing inventory, discuss alternative methods of valuing inventory, explain and demonstrate how to calculate the value of closing inventory from given movements in inventory levels, using FIFO (first in first out) and AVCO (average cost), assess the effect of using either FIFO or AVCO on both profit and asset value, explain the IASB requirements for inventories. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. This relies upon the arrangement of the capable individual over each cost. How many credits do you need to graduate with a doctoral degree? possible scenarios of accounting for such disposal. The issue is should the costs be accrued with goods in transit or wait until they show up. The concept of impairment of assets, clearly introduced in IFRS and, specifically in IAS 36, refers to the amount by which the carrying amount of an asset (or a cash-generating unit or group of assets) exceeds its recoverable amount. selling price is $500 less than the expected selling price, the company has to

Therefore, the cost of transportation from Los Angeles to Guanta can be calculated as. closing inventory. The standard can either be adopted on a modified retrospective or a full retrospective basis. The fact that the same customer, likely facing financial difficulties, might very well be doubtful in connection with amounts owed at a date in the future was completely ignored. In this case, the company needs to make the The basic double-entry accounting structure comes with accounting software packages for businesses. Search AccountingWEB Advertisement Latest Any Answers A client who deals in agricultural machinery had a spare field and bought a dozen ewes and a ram last year. An auditor issues a report about the accuracy and reliability of financial statements based on the country's local operating laws. Dr Inventory $7,500 Cr Income statement $7,500. Purchases A/C

Use actual figures as they appear on your January P&L and B/S, then we might know what you're on about. These were entered into his accounts as stock at cost. Additionally, the nature of the account structure makes it easier to trace back through entries to find out where an error originated. Impairment Assets versus Provisions. At the year-end, the stock held is 4. However, under the new standard, companies would have to apply the potentially more dilutive if-converted method, which assumes share settlement of the entire convertible debt instrument and therefore increases the number of shares to be added to the denominator of the diluted EPS calculation. Stock accounting is the process of recording the transactions entered into by a business enterprise beginning with investments made by anyone, whether a corporation or an individual, in the company in exchange for the issuance of something that can be easily traded in the open market. the inventory write-down is small, companies usually charge the cost of goods

reported profits (i.e., credit cost of goods sold). used in the manufacturing process. Which one of the following lists consists only of items which maybe included in the statement of financial position value of suchinventories according to IAS 2? Closing inventory for accounting purposes has been valued at $7,500. Cost of conversion. a) Impairment. Initially the existence of the inventory, and the quantities thereof, have to be ascertained by means of an inventory count. The journal entry to record impairment is straightforward. debit Unissued Common Stock Here are a few transactions for which Journal Entries are to be recorded. However, before recording the impairment loss, a company must first determine the recoverable value of the asset. Where was the balance sheet 'credit' for this item. Debit represents either an increase in a companys expenses or a decline in its revenue. expense to a separate account. A legal obligation is an obligation that derives from: (a) a contract (through its explicit or implicit terms); A constructive obligation is an obligation that derives from an entitys actions where: (a) by an established pattern of past practice, published policies or a sufficiently specific current statement, the entity has indicated to other parties that it will accept certain responsibilities; and. * Please provide your correct email id. The FOB shipping point means that BDF Inc. (purchaser) will take ownership of the merchandise after leaving SDF Inc.s shipping dock. As the actual Whenever I venture to discuss this issue, I am usually accused of being too zealous or a perfectionist, in my strenuous efforts to apply IFRS. The actual selling price was

Different valuation methods will result in different closing inventory values. When you are paid, that's a credit. This account holds all the impairment losses for assets over their life. The first part of the income statement can be balanced at this stage to show the gross profit figure carried down and brought down. However, most items of inventory willbe stated at cost. WebThis journal entry is made to remove the $10,000 of the damaged inventory from the balance sheet. charge $500 to an expense account (cost of goods sold). Difficult to help without seeing your actual accounting entries (and/or, as Paul suggests, TB) but I dont understand the issue. Companies will welcome the lower interest expense, which was historically very significant relative to the low coupon interest rate on these instruments. Two of the accounts in the system First Answer : It captures all the details about the shipment, such as quantity, type, and destination of the consignment. Whats the best way to scan and attach to Sage? auditors usually watch out for it. The concept of impairment of assets, clearly introduced in IFRS and, specifically in IAS 36, refers to the amount by which the carrying amount of an asset (or a cash-generating unit or group of assets) exceeds its recoverable amount. WebAn example of accounting for stock transactions is: We are looking at a computer retail business that buys and sells computers and parts. In a modern, computerized inventory tracking system, the system generates most of these transactions for you, so the precise nature of the journal entries is not necessarily visible. Although double-entry accounting does not prevent errors entirely, it limits the effect any errors have on the overall accounts. The entry is: There are other types of production-related expenses that are allocated to inventory, such as rent, utilities, and supplies for the manufacturing operation. Double-entry accounting is the process of recording transactions twice when they occur. The auditor should keep a look out on the condition of the inventories during the count. Double Entry: Debit: Bad debts expense a/c Credit: Debtors a/c With the amount of the bad debt. 3 Recording inventory in the ledger accounts, Illustration 2 Recording inventory in the ledger accounts. * Please provide your correct email id. Each member firm is a separate legal entity. New convertible debt accounting guidance (updated August 2020), {{contentList.dataService.numberHits}} {{contentList.dataService.numberHits == 1 ? This may not be the end of changes relating to debt and equity. b) Provisions IAS 37defines provisionsas liabilities of ", Financial Accounting Foundation. Average Shipment Value per Day = $60,000 x 20% / 365, Average Shipment Value per Day = $12,000 per year / 365, Average Shipment Value per Day = $32.87 per day, Goods/ Invoice receipt account to be credited, Goods/ Invoice receipt account to be debited. The entry is: There is also a separate entry for the sale transaction, in which you record a sale and an offsetting increase in accounts receivable or cash. ", Quickbooks. The debits and credits must be equal in order for the system to remain Scenario: Consumed 2 raw materials. company would make the following journal entry to record disposal of the

First, the transactions are entered into the ledger accounts, andthe accounts are balanced. Double-entry accounting is a bookkeeping method that keeps a company's accounts balanced, showing a true financial picture of the company's finances. The Concept of Impairment Losses before and after IFRS. Double-entry is the first step of accounting. In other words, the closing balance of these accounts in one accounting year becomes the opening balance of the succeeding accounting year. Then in the next year, the chief accountant could For finalaccounts purposes, these will be stated at the lower of cost and netrealisable value. The trial balance will include opening inventory, purchases and sales revenue in respect of the inventory transactions. WebProvisions and Other Liabilities 100 When a company acquires certain types of long-term assets, it sometimes has an obligation to remove these assets after the end of their useful lives and restore the site. That is, only if: (1) the conversion option meets the definition of derivative, is not clearly and closely related, and does not qualify for a scope exception from derivative accounting. Double-entry accounting has been in use for hundreds, if not thousands, of years; it was first documented in a book by Luca Pacioli in Italy in 1494.. You are free to use this image on your website, templates, etc., Please provide us with an attribution link. We speak out as the voice of the global accounting profession. WebInventory Reserve Journal Entry. This concept reflects business reality. You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Double Entry (wallstreetmojo.com). Costs which must be excluded from the cost of inventory are: Gordano is a small furniture manufacturing company. Double-entry is based on a simple principle, that for every debitDebitDebit represents either an increase in a companys expenses or a decline in its revenue. we can see from this example, the valuation of inventory as obsolete affects

Overview. assume that on June 1, 20X2 Obsolete Company (a fictitious entity) realized

($100,000 $80,000). Two of the accounts in the system will have this. The double entry for recording the loss is as follows. As a result, you may need to reduce the carrying amount of the inventory item to its market value, and charge the loss on inventory valuation expense for the decrease in recorded cost of the inventory. A formal title for the sheets recording the inventorycount is period-end inventory records. WebGross profit without stock journal entries would be sales minus purchases. It's also important for the company's balance sheet to equal zero. The current accounting by issuers for convertible debt instruments can vary dramatically depending on the instruments terms. Why fibrous material has only one falling period in drying curve? 5 Methods of calculating cost of inventory. Provision for gratuity a/c. Your provision in P&L was a one time 'hit' so obviously that resets for the new year. It may be acceptable to considergroups of items together if all are worth less than cost. Copyright 2023 . Difference Between Double Entry and Single Entry, It is the method of accounting where the dual aspect of the transaction is recorded, It is the method of accounting where only one side of transaction is recorded, It provides more accurate financial results. How have you got a 50k provision on your balance sheet if all your provisions are reset to zero? income statement (through an expense account). The debit has to be applied to income, and the asset shown at its net recoverable amount. BIK tax on a car loaned to another business? Accounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities. The inventory is an asset and therefore is a debit entry in the inventoryaccount. There are three different types of accounts, Real, Personal and Nominal AccountsNominal AccountsNominal Accounts are the general ledger accounts which are closed by the end of an accounting period. It serves as the shipment receipt when the carrier hands over the consignment to the intended merchant.read more, invoice or air waybill), then the journal entry will be: When the stock is in transit but yet to be received by the purchaser customer, then the journal entry will be: When the merchandise is received by the purchaser, then the journal entry will be: The recording of goods in transit in either the sellers or the buyers accounting books depends on the terms of shipping, which are: FOB Shipping Point: When the shipping terms say FOB shipping point, the ownership of goods in transit is transferred to the buyer once the shipment leaves the sellers warehouse. Excessive build up of certain lines of inventory whilst having insufficient inventory of other lines is avoided. Otherwise, is there a chance you posted your original provision as a reversing entry and it has reversed in the new year? Loss A/C. In particular, any percentage additions to cover overheads must be based on the normal level of production. The standard requires inventories to be measured at the lower of cost and net realisable value (NRV) and outlines acceptable methods of determining cost, including specific identification (in some cases), first-in first-out (FIFO) and weighted Although, the duration between dividend declared and paid is usually not long, it is still important to make the two separate journal entries. The total of the trial balance should always be zero, and the total debits should be exactly equal to the total credits. Cash accounting and accrual accounting are the two significant accounting methods. But when doing Jan accounts I'm left with a 50k mismatch between stock valuation on P+L and that on the BS due to the provision having reset itself tozero on P+L but remaining at 50k on BS. Take accounts receivable, for example: if a debtor had several amounts outstanding, the concept of doubtful was only applied to those amounts overdue. So, in addition to writing

Ever since the adoption of International Financial Reporting Standards (IFRS), preparers of financial statements here in Brazil, and dare I speculate in other countries that have adopted IFRS, have been misused the word provision. You need to do a better job at writing your question. Debit an account called investments and credit an account called (a)Ledger accounts before extracting a trial balance. 2: On July 2, 20X2, Obsolete Company decided to sell the obsolete

will have this. inventory is a contra-asset account. "Accounting Standards. In what circumstances might the NRV of inventories be lower than their cost? Before IFRS, this concept was limited almost exclusively to trade accounts receivable and obsolete or slow-moving inventories. Here we discuss the rules and principles of double-entry along with its example, advantages, and disadvantages. Prepare the income statement for the first week of trading under both FIFO and AVCO. This reclassification can make it easier for people who use the company's financial statements to understand the different categories of inventory. So, we need to understand what account kind of debits and what credits. There is no provision and, as such, no liability to be stated in the balance sheet. Calculate the gross profit for the year ended 31 December 20X7. At the end of the accounting period, such inventory items warrant special attention for accounting. Issuers will need to assess the impact of the changes to their existing convertible debt agreements and derivative contracts as well as to future issuances. There are also two special situations that arise periodically, which are adjustments for obsolete inventory and for the lower of cost or market rule. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. The purchases and sales figures have been built up over the year and represent the years accumulated transactions. They will be analysed as follows in the notes to the accounts: NRV may be relevant in special cases, such as where goods areslow-moving, damaged or obsolete. Account. both balance sheet (through the allowance for obsolete inventory account) and

RM 2 total cost is 420. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction. Webcan anyone send me double entry for stock provision ? 2014-05-23 22:42:46. This must be transferred to the income statement ledger account with the following entry: The closing inventory is entered into the ledger accounts with the following entry: Once these entries have been completed, the income statement ledger account contains both opening and closing inventory and the inventory ledger account shows the closing inventory for the period to be shown in the statement of financial position. Trevor Williams/Getty Images. Tel: +1 (212) 286-9344 Provision amount is 200,000. further stock is over valued by 100,000 what will be the accounting entry for over obsolete inventory to the original supplier. Let us take an example in which SDF Inc. is the seller, and BDF Inc. is the purchaser. Sales A/C If this provision was not made, the inventory could be overvalued at the end of a period of low production, because there would be a smaller number of items over which to spread the overhead cost. Finished Good Standard Cost is 595.35 Production BOM Standard This includes labour costs booked and sundry material costs (e.g. The income statement cannot be completed (and hence gross profit calculated) until the closing inventory is included. #2 Personal Accounts Debit the Receiver and Credit the Giver. He was simply the first to describe the accounting methods that were already common practice among merchants in Venice. For example, accounts could have reflected the following: Dr Stock 950,000 Continuing from previous Illustration, we will now see how the ledger accounts for inventory are prepared. Closing Stock - Adjustment during Final Accounting The value of closing stock is ascertained through physical verification of the stock and its valuation at cost or The terms allowance for doubtful accounts and provision for obsolete inventories have been in our vocabularies for decadesat least those of us trained in the days before IFRS was born. reverse the $1,000 expense recognized earlier. Depending on the type of inventory and how much Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. Because the accounts are set up to check each transaction to be sure it balances out, errors will be flagged to accountants quickly, before the error produces subsequent errors in a domino effect. It is not unusual for a sole trader to take inventory from theirbusiness for their own use. #1 Real Accounts Debit what comes in and Credit what goes out. Additional entries may be needed besides the ones noted here, depending upon the nature of a company's production system and the goods being produced and sold. To

Determine which company should record the goods in transit in their accounting books if the terms of the delivery freight are on board (FOB)shipping point. The minimum amount of subscription necessary for the The entry for the former situation is: Once the production facility has converted the work-in-process into completed goods, you then shift the cost of these materials into the finished goods account with the following entry: At the end of each reporting period, allocate the full amount of costs in the overhead cost pool to work-in-process inventory, finished goods inventory, and the cost of goods sold, usually based on their relative proportions of cost or some other readily supportable measurement. profit is understated in the income statement (as cost of sales is too high). For example, the Salary Paid account is debited, and the rent received account is credited. Goods in transit refer to the inventory items that have been purchased by the buyer and shipped by the seller; however, the goods are on the way and yet to reach the intended purchaser. However, companies may not appreciate the more dilutive impact of the changes to EPS for instruments that may be settled in any combination of cash or shares. But when It also clarifies that these items represent adjustments to the carrying value of assets. That is, these items are not provisions in the IFRS lexicon and so should not be labelled as such when applying IFRS. Most accounting software for business uses double-entry accounting; without that feature, an accountant would have difficulty tracking information such as inventory and accounts payable and preparing year-end and tax records. So, the cost of good in transit will be $60,986 (= $60,000 + $986). It is based on a dual aspect, i.e., Debit and Credit, and this principle requires that for every debit, there must be an equal and opposite credit in any transaction. Rules of recording the transactions are decided based on the type of account. However, when the write-down is large, it is better to charge the

Who is the actress in the otezla commercial? We work to prepare a future-ready accounting profession. Created at 5/24/2012 3:31 PM by System Account, (GMT) Greenwich Mean Time : Dublin, Edinburgh, Lisbon, London, Last modified at 5/25/2012 12:53 PM by System Account, explain the need for adjustments for inventory in preparing financial statements, illustrate income statements with opening and closing inventory, explain and demonstrate how opening and closing inventory are recorded in the inventory account, explain the IAS 2 requirements regarding the valuation of closing inventory, define the cost and net realisable value of closing inventory, discuss alternative methods of valuing inventory, explain and demonstrate how to calculate the value of closing inventory from given movements in inventory levels, using FIFO (first in first out) and AVCO (average cost), assess the effect of using either FIFO or AVCO on both profit and asset value, explain the IASB requirements for inventories. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. This relies upon the arrangement of the capable individual over each cost. How many credits do you need to graduate with a doctoral degree? possible scenarios of accounting for such disposal. The issue is should the costs be accrued with goods in transit or wait until they show up. The concept of impairment of assets, clearly introduced in IFRS and, specifically in IAS 36, refers to the amount by which the carrying amount of an asset (or a cash-generating unit or group of assets) exceeds its recoverable amount. selling price is $500 less than the expected selling price, the company has to

Therefore, the cost of transportation from Los Angeles to Guanta can be calculated as. closing inventory. The standard can either be adopted on a modified retrospective or a full retrospective basis. The fact that the same customer, likely facing financial difficulties, might very well be doubtful in connection with amounts owed at a date in the future was completely ignored. In this case, the company needs to make the The basic double-entry accounting structure comes with accounting software packages for businesses. Search AccountingWEB Advertisement Latest Any Answers A client who deals in agricultural machinery had a spare field and bought a dozen ewes and a ram last year. An auditor issues a report about the accuracy and reliability of financial statements based on the country's local operating laws. Dr Inventory $7,500 Cr Income statement $7,500. Purchases A/C

WebA provision for the removal of the plant and rectification of damages caused by its construction of CU 800 000 shall be recognized when the plant is being constructed, as the construction itself gives rise to an obligation to remove it.

stock provision double entry