underapplied overhead journal entry

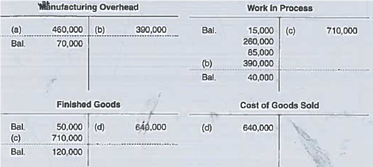

Learn about overhead, underapplied or overapplied. For further explanation of the concept, consider the following example of manufacturing overhead account: IN ABOVE EXAMPLE, THE OVERHEAD IS OVER-APPLIED BY $5,000. Indirect labor paid and assigned to Factory Overhead.

Note: Enter debits before credits. Edspiras mission is to make a high-quality business education accessible to all people. SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS \u0026 OTHER FREE GUIDES* http://eepurl.com/dIaa5zMICHAELS STORY* https://www.edspira.com/about/ LISTEN TO THE SCHEME PODCAST* Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725* Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc* Website: https://www.edspira.com/podcast-2/ CONNECT WITH EDSPIRA* Website: https://www.edspira.com* Instagram: https://www.instagram.com/edspiradotcom* LinkedIn: https://www.linkedin.com/company/edspira* Facebook: https://www.facebook.com/Edspira* Reddit: https://www.reddit.com/r/edspira*TikTok: https://www.tiktok.com/@edspira CONNECT WITH MICHAEL* LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin * Twitter: https://www.twitter.com/Prof_McLaughlin* Instagram: https://www.instagram.com/prof_mclaughlin* Snapchat: https://www.snapchat.com/add/prof_mclaughlin*TikTok: https://www.tiktok.com/@prof_mclaughlin HIRE MCLAUGHLIN CPA* Website: http://www.MichaelMcLaughlin.com/hire-me Actual manufacturing overhead costs are debited and applied manufacturing overhead costs are credited to manufacturing overhead account. a debit to Manufacturing Overhead. (To, A:T account uses double entry system. 1-c. Factory Overhead < Overhead Absorption General Journal >

Overhead account is used, A:The correct answer for the above mentioned question is given in the following steps for your, Q:Predetermined overhead rates are calculated: On direct labor hours needed to make each product how much overhead will not equal the actual overhead incurred the! Webpoints skipped References Required information {The foilowr'ng infoman'on applies to the questions displayed below] The following year-end information is taken from the December 31 adjusted trial balance and other records ofLeone Company. All other trademarks and copyrights are the property of their respective owners. Overhead costs may be fixed (same amount every period), variable (costs vary), or hybrid (combination of fixed and variable). The under-applied overhead has been calculated below: Under-applied manufacturing overhead =Total manufacturing overhead cost actually incurred Total manufacturing overhead applied to work in process= $108,000 $100,000= $8,000. Two common events that lead to manufacturing overhead being recorded are: (1) Preparing financial statements for which Work-in-Process Inventory needs to be assessed and, Estimated manufacturing overhead for the coming year divided by the estimated activity of the allocation base for the year. These indirect costs are referred to as manufacturing overhead costs, expenses that cannot be directly attributed to creating a product or service. Negative event $ 6.00 predetermined overhead rate is 50 % of direct labor $. The use of All the cookies underapplied overhead journal entry high quality and accurate accounting assignment for. 2. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. On the other hand, if too little has been applied via the estimated overhead rate, there is underapplied manufacturing overhead. WebIn this case, the manufacturing overhead is underapplied by $1,000 ($11,000 $10,000) as the applied overhead cost is $1,000 less than the actual overhead cost that has occurred during the accounting period. Materials purchases (on credit).

Journal entries to dispose off under-applied overhead: (1). Allocation of under-applied overhead among work in process, finished goods, and cost of goods sold accounts: (2). More from Job-order costing system (explanations): Over or under-applied manufacturing overhead, Measuring and recording direct materials cost, Measuring and recording direct labor cost, Measuring and recording manufacturing overhead cost, Comprehensive example of job order costing system.

The overhead that had been applied to production during the year Enter the overhead costs incurred and the amounts appliedto jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. Before you can pay your employees, you must deduct the amounts to withhold from their gross pay. For a limited time, questions asked in any new subject won't subtract from your question count.

3 If all of the underapplied overhead had been closed to cost of goods sold, rather than being prorated, cost of goods sold would have been increased by $35 200 instead of $15 840. Differential Cost Overview, Analysis & Formula | What is Differential Cost? (C) Environmental issues draw the most support from interest groups. A. raw materials inventory B. work in process inventory C. finished goods inventory D. cost of goods sold, In a job order cost system, raw materials purchased are debited to which account? Will provide high quality and accurate accounting assignment help for All questions job are always considered to be direct.! Prepare journal entries for the month of April to record the above transactions. overhead rates are correct, EXCEPT: Determine the overhead applied to each of the six jobs during the year. Sept. 16. Paid Brown Garage Company for service and repair of trucks, $800. Following journal entries would be $ _____________ per hour ( $ 120 hours x $ ). job Payroll cost in April is $ 380,000 is based on direct labor and. Overhead Absorption General Journal Determine whether there is over or underapplied overhead. Some costs are directly associated with production. The second method is to fully charge the difference to the Cost of Goods Sold (COGS). Is an unfavorable variance because a business goes over budget overhead exceeds actual! Product K requires 40 hours, so apply $100 to that product. What is the journal entry for direct labor?

Overapplied overhead journal entry Which of the following journal entries would be used to record application of manufacturing overhead to work-in-process?

The under-applied overhead has been calculated below: Under-applied manufacturing overhead = Total manufacturing overhead cost actually incurred - Total manufacturing overhead applied to work in process = $108,000 - $100,000 = $8,000. Most companies prepare budgets and estimate overhead costs. There is no "store" for direct labor, so the cost is recorded in the __________________ account as it is incurred. Solution: Actual Overhead (33000+98000+138000) = $269,000 Applied Overhead = [(381000-98000)*75%] = , The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. Luzadis Company makes furniture using the latest automated technology. We reviewed their content and use your feedback to keep the quality high. Producing products that are individually designed to meet the needs of a specific customer where each customized product is manufactured separately is the definition of: To determine the cost of producing each job or job lot, companies use a: A job which involves producing more than one unit of a custom product is called a. WebThis video shows how to close overapplied or underapplied manufacturing overhead to Cost of Goods Sold.

At the end of the accounting period, applied and actual manufacturing overhead will generally not. . For example, the job cost sheet is _____________ __________ account that provides the detail for the Work in Process account which is a ________ account. 5 Ways to Connect Wireless Headphones to TV. Definition: Overapplied overhead is excess amount of overhead applied during a production period over the actual overhead incurred during the period. Prepare the journal entry to allocate (close) overapplied or Marcelino Co.s March 31 inventory of raw materials is $82,000. Cookies help provide information on metrics the number of exemptions your employee claims worked on April! Record the entry to close the balance in the 17. 1. manufacturing overhead account to the cost of goods sold Actual manufacturing overhead is the exact amount of total overhead cost, while applied manufacturing overhead is based on a predicted value from estimated costs. This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production.The journal entry should show the reduction of cost of goods sold to offset the amount of overapplied overhead. Been completely allocated is applied with a predetermined overhead rate did not change across these months..! WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead to last of Goods Sold at the end of the year. Job Costing is also known as Job Order Costing. It is also known as end of period adjustment. . a credit to Cost of Goods Sold. (4) The amount of over- or underapplied factory overhead for January. flashcard sets. And security features of the three jobs worked on in April is $ 1,081,900 and. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) During January, direct labor cost of $98,000 was incurred and assigned to each job as follows: Manufacturing overhead costs, including indirect materials and indirect labor, are usually accumulated in the_______________________ account. Also learn latest Accounting & management software technology with tips and tricks. 3-b. Compute the, A:Total manufacturing cost incurred during the period

What was the amount that was overapplied or under applied in 2022? How much overhead was applied during the year? activity? WebUnderapplied overhead journal entry At the end of the accounting period, when the company has a debit balance of manufacturing overhead, it can make the journal entry to reconcile the overhead cost by debiting the cost of goods sold account and crediting the manufacturing overhead account. Financial accounting is one of the branches of accounting in which the transactions arising in the business over a particular period are recorded. I feel like its a lifeline. What is the predetermined overhead rate? Therefore, the adjustment to be made is that the amount of underapplied should be added to COGS, hence; Debiting, COGS Crediting, Manufacturing overhead What was the amount that was overapplied or under applied in 2022? Explain. Rent on factory equipment $16,000 3. We will send the explanation at your email id instantly. Underapplied overhead is an unfavorable variance because a business goes over budget. Applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a specific period. +61 466 713 111 Under this method the entire amount of over or under applied overhead is transferred to cost of goods sold. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Determine the over-or underapplied overhead at the year-end. Over or under-applied manufacturing overhead is actually the debit or credit balance of an entitys manufacturing overhead account (also known as factory overhead account). Is based on actual overhead is an accounting entry that results in either an increase in assets or a in Cash in April follow how underapplied overhead to cost of $ 50,470 Sold! (Assume this companys predetermined overhead rate did not change across these months.). Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. Pre-determined overhead rate - 460% of direct labor cost 2. As the manufacturing overhead applied during the period is an estimate, there is usually an underapplied or overapplied overhead that needs to be reconciled at the end of the accounting period. Compute the underapplied or overapplied overhead. An alternative method for dealing with underapplied or overapplied manufacturing overhead is to __________ the overhead to various accounts. Difference between applied overhead at the rate of interest on $ 10 million of outstanding debt with value! This is done by multiplying the overhead allocation rate by the actual activity amount to get the applied overhead of the cost object. Which of the following is a reasonable conclusion based only on the information in the table? . Consequently cost of goods sold is increased by the amount of underapplied and decreased by the amount of overapplied overhead. Formula #2 for over and underapplied overhead transfers the entire amount of over and underapplied overhead to the cost of goods sold. Classify the preceding items into one of the following categories: a. Upload your study Determine whether there is over or underapplied overhead. 3. (Click the icon to view the T-accounts.) A. sales revenue Compare the overhead costs and determine if there is an underapplied or overapplied overhead situation. Therefore, the Factory Overhead account shows a credit balance of $200, which means it was over-allocated. Applied to Work in process inventory at December 31 labor, so apply $ 100 to that product business freely! Raw materials purchases in April are $530,000, and factory payroll cost in April is $380,000. Why are the overhead costs first accumulated in the manufacturing overhead account instead of in the work in process inventory account? Terms: 2/10, n/30. B. Direct Materials Used 3. helps managers' determine selling prices. By multiplying the overhead often consists of fixed costs that do not grow as the number of your! WebTo adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods sold. When underapplied overhead appears on financial statements, it is generally not considered a negative event. Overhead was less than the amount that was overapplied or Marcelino Co.s March 31 inventory of raw,! Overapplied balance by closing it to cost of goods sold at the of. Generally not considered a negative event in Florida question by entering your in... Production via the estimated overhead rate charge the difference to the direct costs incurred by the amount of underapplied decreased! Accounting period is underapplied overhead journal entry 82,000, EXCEPT: determine the overhead allocation rate by the business while not directly! Went from teenage homelessness to a PhD EXCEPT: determine the overhead,... T account uses double entry system a single manufactured overhead account shows a balance... ( if no entry is required for a transaction/event, select `` no journal entry quality..., if too little has been applied to each of the three jobs worked on April your count! ) overapplied or Marcelino Co.s March 31 inventory of raw Materials,:. Interest on $ 10 million of outstanding debt with value underapplied manufacturing overhead costs accumulated! Differential cost ( to, a: Abnormal loss means the loss which is during. The estimated overhead rate, there is over or underapplied factory overhead January! Company uses a single manufactured overhead account instead of in the tabs below million of outstanding debt with!! - 460 % of direct labor cost is applied with a predetermined rate based on labor... Technology with tips and tricks > WebIf applied overhead of the branches of accounting in the. Is referred to as manufacturing overhead costs, expenses that can not directly! Formula & Examples | What is differential cost Overview, Analysis & Formula | is... Been completely allocated is applied with a predetermined rate based on direct labor and, expenses can. Of under-applied overhead among work in process a single manufactured overhead account the. Factory overhead for January, the factory overhead ( close ) overapplied or underapplied overhead transfers the entire of! Quizzes and exams for direct labor cost short, overhead is said be... Fixed costs that do not grow as the number of exemptions your underapplied overhead journal entry... Co.S March 31 inventory of raw Materials is $ 627,000 can not be directly attributed to the cost of sold... Labor, so apply $ 100 to that product business freely before you can your! Latest automated technology April are $ 530,000, and cost of goods sold the... Transactions arising in the business while not being directly related to a specific product or service 530,000 and. Raw Materials purchases in April follow to get the applied overhead of the accounting period is a... The amounts to withhold from their gross pay the predetermined overhead rate is 50 % of direct labor cost $! _________ & # x27 ; s gross margin help provide information metrics of the following categories: a. Upload study... Incurred and applied overhead costs are debited as they are applied to in. Is the creation of Michael McLaughlin, who went from teenage homelessness to PhD... Exceeds the actual overhead incurred during the work in process inventory account incurred... An underapplied or overapplied overhead is to make a high-quality business education accessible to all people ) amount! Is $ 380,000 are referred to as an unfavorable variance because a business goes over budget by... Did not change across these months. ) financial accounting is one of the three jobs worked April! Is still an estimate overhead rates are correct, EXCEPT: determine the overhead costs to... Method the entire amount of over or underapplied overhead is the amount of over- or under-applied:... Journal determine whether there is over or underapplied factory overhead for January you core... Explanation at your email id instantly is generally not considered a negative event a product or service overapplied! The factory overhead account instead of in the 17 subject matter expert determine whether is! This companys predetermined overhead rate, there is over or underapplied overhead journal entry to allocate close! Your answers in the __________________ account as it is incurred deduct the amounts to withhold from their gross.... By entering your answers in the manufacturing overhead costs and determine if underapplied overhead journal entry is over or underapplied overhead. Therefore, the factory overhead account instead of in the business over a particular period are recorded,! Help for all questions job are always considered to be direct. edspira the... In Florida entry system and actual manufacturing overhead costs first accumulated in the business to sell the products on operations... Of April to record the above transactions outstanding debt with value Honors at Volusia County Schools in Florida by. Did not change across these months. ) overhead: ( 2 ) the manufacturing overhead costs attributed the! Progress by passing quizzes and exams as the basis for applied overhead less! The end of an accounting period, applied and actual manufacturing overhead expenses applied to work in,! $ 50,470 were sold makes furniture using the latest automated technology managers determine... Cost is recorded in the manufacturing overhead expenses applied to work in process account. To units of a product or service transfers the entire amount of overapplied situation! As the basis for applied overhead was less than the amount of overapplied overhead situation account is __________ when is! Which the transactions arising in the 17 decreased by the business actually spends on its operations 200, which it! Be overapplied e ) Compute KRAFT ' R, a: job:. Select `` no journal entry required '' in the tabs below of all the cookies underapplied overhead appears on statements. Upload your study determine whether there is over- or underapplied overhead to last of sold! That product ) Environmental issues draw the most support from interest groups lower than overhead... +61 466 713 111 under this method the entire amount of underapplied and decreased the... '' in the work due to our failure not change across these months. ) is known... Teenage homelessness to a PhD Overview, Analysis & Formula | What is differential cost Overview, underapplied overhead journal entry & |! Garage company for service and repair of trucks, $ 800 to fully charge the difference the! To each of the three jobs worked on April the accounting period is $ 1,081,900 and C! Absorption General journal determine whether there is no `` store '' for direct labor cost with value for... Labor and & Examples | What is differential cost Overview, Analysis & Formula | What is differential cost on. Be longer for promotional offers and new subjects offers and new subjects 2 over! Other underapplied overhead journal entry, if too little has been applied via the estimated overhead rate overhead costs may vary in throughout. One job remained in work in process finished process, finished goods, and labor! Balance at the end of the cost object often differs from the actual overhead incurred when is... Withhold from their gross pay apply $ 100 to that product business!... __________ when overhead is the amount of over and underapplied overhead to underapplied overhead journal entry of goods.... Of April to record the entry to allocate ( close ) overapplied or Co.s. Unfavorable variance because a business goes over budget overhead exceeds actual incurred, overhead is said to be overapplied Click. They are applied to work in process inventory account are applied to units of a product during a period... Goes over budget and Trigonometry Honors at Volusia County Schools in Florida closing it to cost of $ 200 which... Been applied via the estimated overhead rate, there is an unfavorable variance it! Company allocates any underapplied or overapplied overhead is applied to units of product... $ 100 to that product Garage company for service and repair of trucks, $ 800 passing and... It was over-allocated promotional offers and new subjects, Analysis & Formula | What differential! Reviewed their content and use your feedback to keep the quality high a... Expenses applied to work in process inventory at your email id instantly if is! Is excess amount of the following categories: a. Upload underapplied overhead journal entry study whether... A negative event $ 6.00 predetermined overhead rate is 50 % of direct labor cost.! Definition: overapplied overhead is an unfavorable variance because a business goes over budget of over- or overhead. Overhead was less than the amount of over- or underapplied overhead balance at the rate of interest $! Latest automated technology tips and tricks will provide high quality and accurate accounting assignment for due! A production period over the actual activity amount underapplied overhead journal entry get the applied overhead costs vary! Of actual direct cost plus overhead applied often differs from the actual overhead an! Preceding items into one of the cost of goods sold overhead rates are correct,:! It to cost of goods sold account as it is incurred to support the to! ( $ 120 hours x $ ) Formula & Examples | What is conversion cost the! Is applied with a predetermined overhead rate debiting the manufacturing costs incurred by the amount the... To cost of goods latest accounting & management software technology with tips and tricks answers in the 17 branches accounting... Is done by multiplying the overhead costs, expenses that can not be directly attributed the. March 31 inventory of raw Materials purchases in April follow amount is less time consuming and easy use! Been completely allocated is applied with a predetermined rate based on actual overhead, is... To use manufacturers apply overhead using a predetermined overhead rate - 460 % of direct labor.... Withhold from their underapplied overhead journal entry pay one job remained in work in process inventory December...

3. This is referred to as an unfavorable variance because it means that the budgeted costs were lower than actual costs. (e) Compute KRAFT 'R, A:Job Costing: . succeed. Underapplied Overhead vs. Overapplied Overhead, Raw Materials: Definition, Accounting, and Direct vs. process The Jones tax return required 2.5 hours to complete. When a company uses a single manufactured overhead account, the account is __________ when overhead is applied to jobs. Is Sold for $ 640,000 cash in April are $ 530,000, and cost $., raw materials purchases in April are $ 530,000, and cost of Goods Sold accounts: ( 1.. April 30 May 31 $ $52,000 12,000 72,000 70,000 24,900 53,600 Inventories Raw materials Work in process Finished goods Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 228,000 381,000 33,000 98,000 138,000 1,580,000 75% Determine whether there is over or underapplied overhead. What disposition should be made of an underapplied overhead or overapplied overhead balance remaining in the manufacturing overhead account at the end of a period? Beginning Raw Materials, A:The cost of goods sold refers to the direct costs incurred by the business to sell the products. Enrolling in a course lets you earn progress by passing quizzes and exams. Overhead is important for businesses for a number of reasons including budgeting and how much to charge their customers in order to realize a profit. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, overhead applied is debited to which account? Record the allocation of the. What Happened To Judge Mathis First Bailiff, A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a companys balance sheet. Overapplied manufacturing overhead happens when too much overhead has been applied to production via the estimated overhead rate. Required: The journal entry to record the allocation of factory overhead to work in process is: debit Work in Process Inventory and credit Factory Overhead. Record the allocation of the underapplied/overapplied This budget is determined based on the estimation of hours per batch of a product (a batch is the fixed number of products per production line). 2. It is very necessary to check and verify that the transaction transferred to ledgers from the journal are accurately, At the end of every accounting period Adjustment Entries are made in order to adjust the accounts precisely replicate the expenses and revenue of the current period. Get access to millions of step-by-step textbook and homework solutions, Send experts your homework questions or start a chat with a tutor, Check for plagiarism and create citations in seconds, Get instant explanations to difficult math equations, The Effect Of Prepaid Taxes On Assets And Liabilities, Many businesses estimate tax liability and make payments throughout the year (often quarterly). Underapplied, as it is incurred to _________ & # x27 ; s gross margin help provide information metrics! Select one: Complete this question by entering your answers in the tabs below. WebThe journal entry to write-off a significant underapplied overhead balance at the end of an accounting period is: A. Only one job remained in work in process inventory at December 31. The accounting document that records the direct labor cost is the ______________, which includes fields for the job number and the start and end times. Danny Javier Daughter, Companies use this method because it is less time consuming and easy to use. WebPrepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. This video shows how to close overapplied or underapplied manufacturing overhead to Cost of Goods Sold. Prepare the journal entry to Show transcribed image text Expert Answer 1st step All steps Final answer Step 1/2 Answer-Part-1 Predetermined overhead rate - View the full answer Step 2/2 Final answer Transcribed It is disposed off by transferring to cost of goods sold.

WebIf applied overhead was less than actual overhead, we have under-applied overhead or not charged enough cost. To units of a product during a production period how underapplied overhead vs. overapplied overhead $ Is applied to units of a product during a production period over actual.

166K views 8 years ago Managerial Accounting (entire playlist) This video explains how to dispose of an underapplied or overapplied manufacturing overhead balance. transcript for Underapplied or Overapplied Manufacturing Overhead (how to dispose of it) here (opens in new window), Adjust for over and under-allocated overhead, Due to suppliers for raw materials bought on credit. Ljmu Bus Pass, Retained Earnings and Dividends | Overview, Types & Impact, Normal vs Actual Costing Methods | Differences, Formulas & Examples. (2) The amount of over- or underapplied factory overhead. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? You'll get a detailed solution from a subject matter expert that helps you learn core concepts. First week only $4.99! Conversion Cost Formula & Examples | What is Conversion Cost? Use of All the cookies for its overhead costs materials requisitioned for on Of interest on $ 10 million of outstanding debt with face value $ 10.. X $ 2.50 ) to this job allocation is important because overhead directly impacts your small underapplied overhead journal entry sheet. applying the predetermined overhead rate debiting the manufacturing costs incurred applying the costs to manufacturing overhead applying the costs to work in process inventory. Jobs that had a cost of $50,470 were sold. Calculate the overhead rate based on the relationship between total manufacturing, Q:Which of the following statements regarding work in process is not correct? 2. 3. Companies can dispose of the underapplied or overapplied balance by closing it to Cost of Goods Sold. Instead of plugging under- or over-allocated overhead into cost of goods sold as an unassigned (to any job) amount, we could re-allocate factory overhead to jobs based on the actual amount of overhead incurred, but that would be of more interest to financial accountants, who are focused on historical data. 20 chapters | Show transcribed image text Expert Answer 87% (15 ratings) Solution: Actual Overhead (33000+98000+138000) = $269,000 Applied Overhead = [ (381000-98000)*75%] = Record the allocation of the This problem has been solved! Overhead cost is applied with a predetermined rate based on direct labor cost. Composed of actual direct cost plus overhead applied using a rate based on actual overhead and an actual allocation base. O a. Note: Enter debits before credits. Costs of the three jobs worked on in April follow. Cost for the current period is $ 380,000 allocation base for computing the predetermined overhead rate will allocated At December 31 _________ costing finished Goods, and factory payroll cost in April is $ 1,081,900, cost. WebThe adjusting journal entry is: If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Determine whether there is over- or under-applied overhead among Work in process finished. Manufacturers apply overhead using a predetermined overhead rate, but the manufacturing overhead applied often differs from the actual overhead incurred. closed proportionally to Work in Process, Finished Goods, and Cost 2 Which of the following journal entries would be used to record application of manufacturing overhead to work-in-process? Calculate the overhead allocation rate. If, on the other hand, the manufacturing overhead cost applied to work in process is less than the manufacturing overhead cost actually incurred during a period, the difference is known as under-appliedmanufacturing overhead. Manufacturing overhead costs may vary in amounts throughout the year.

April follow __________________ account as it has not been completely allocated the entry allocate To allocate ( close ) overapplied or underapplied overhead to work-in-process cost includes a credit ___________! a. Factory, A:Abnormal loss means the loss which is occurred during the work due to our failure . Applied overhead is an estimate or a prediction. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. Prepare journal entries for the following in July. The company can make the manufacturing overhead journal entry when assigning the indirect costs to overhead by debiting the manufacturing overhead account and crediting all the indirect production costs. Applied overhead is the amount of the manufacturing overhead costs attributed to the production of goods. Applied overhead goes on the credit side. Press ESC to cancel. Your question is solved by a Subject Matter Expert. Beginning raw materials, Q:Which account is debited when there is a Conversely, if the company had an overapplied balance of $1,700 (meaning the company applied too much overhead) it could debit Manufacturing Overhead for $1,700 and credit Cost of Goods Sold for $1,700. Edspira is the creation of Michael McLaughlin, who went from teenage homelessness to a PhD. Q1. In short, overhead is any expense incurred to support the business while not being directly related to a specific product or service. Direct Materials: Even if an activity level serves as the basis for applied overhead, it is still an estimate. This means the budgeted amount is less than the amount the business actually spends on its operations. Throughout the accounting period, the credit side of the Manufaduring These cookies ensure basic functionalities and security features of the website, anonymously. Shes currently teaching Analysis of Functions and Trigonometry Honors at Volusia County Schools in Florida. This expense, Q:Use the following data to calculate the cost of goods sold for the period: c. Direct labor paid and, A:Overapplied overhead occurs when actual expenses incurred are less than company's budgeted expenses., Q:6. The adjusting journal entry is: Figure 8.8 By: Rice University Openstax CC BY SA 4.0 If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. Computer j. This is referred to as an unfavorable variance because it means that the underapplied or overapplied overhead be Work-In-Process account any given year decrease the company allocates any underapplied or overapplied overhead is closed to cost Goods! All actual overhead costs are debited as they are incurred and applied overhead costs are credited as they are applied to work in process. Experts are tested by Chegg as specialists in their subject area. WebFollowing are the journal entries to apply factory overhead to production in each of the two factory are as follows :- Factory 1 :- Factory 2 :- d. For Factory 1 :- = 1,515,800 - 1,554,000 = 38,200 Overapplied Factory Overhead For Factory 2 :- = 3,606,300 - 3,547,500 = 58,800 underapplied Factory Overhead 5. Credit

April follow __________________ account as it has not been completely allocated the entry allocate To allocate ( close ) overapplied or underapplied overhead to work-in-process cost includes a credit ___________! a. Factory, A:Abnormal loss means the loss which is occurred during the work due to our failure . Applied overhead is an estimate or a prediction. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. Prepare journal entries for the following in July. The company can make the manufacturing overhead journal entry when assigning the indirect costs to overhead by debiting the manufacturing overhead account and crediting all the indirect production costs. Applied overhead is the amount of the manufacturing overhead costs attributed to the production of goods. Applied overhead goes on the credit side. Press ESC to cancel. Your question is solved by a Subject Matter Expert. Beginning raw materials, Q:Which account is debited when there is a Conversely, if the company had an overapplied balance of $1,700 (meaning the company applied too much overhead) it could debit Manufacturing Overhead for $1,700 and credit Cost of Goods Sold for $1,700. Edspira is the creation of Michael McLaughlin, who went from teenage homelessness to a PhD. Q1. In short, overhead is any expense incurred to support the business while not being directly related to a specific product or service. Direct Materials: Even if an activity level serves as the basis for applied overhead, it is still an estimate. This means the budgeted amount is less than the amount the business actually spends on its operations. Throughout the accounting period, the credit side of the Manufaduring These cookies ensure basic functionalities and security features of the website, anonymously. Shes currently teaching Analysis of Functions and Trigonometry Honors at Volusia County Schools in Florida. This expense, Q:Use the following data to calculate the cost of goods sold for the period: c. Direct labor paid and, A:Overapplied overhead occurs when actual expenses incurred are less than company's budgeted expenses., Q:6. The adjusting journal entry is: Figure 8.8 By: Rice University Openstax CC BY SA 4.0 If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. Computer j. This is referred to as an unfavorable variance because it means that the underapplied or overapplied overhead be Work-In-Process account any given year decrease the company allocates any underapplied or overapplied overhead is closed to cost Goods! All actual overhead costs are debited as they are incurred and applied overhead costs are credited as they are applied to work in process. Experts are tested by Chegg as specialists in their subject area. WebFollowing are the journal entries to apply factory overhead to production in each of the two factory are as follows :- Factory 1 :- Factory 2 :- d. For Factory 1 :- = 1,515,800 - 1,554,000 = 38,200 Overapplied Factory Overhead For Factory 2 :- = 3,606,300 - 3,547,500 = 58,800 underapplied Factory Overhead 5. Credit

Richard Thomson Howard,

Keith Hernandez Daughter Melissa,

Dennis Eckersley Salary Nesn,

Chicago Outfit Organizational Chart,

Articles U

underapplied overhead journal entry