the record obituaries stockton, ca

Monday Morning Quarterback (Monday, April 3, 2023) Mortgage rates fell to their lowest level in six weeks. Enter the name of the street without the ending Street or Avenue. Lets compare Florida, Texas, and California. Also included are the median state home value, the median real estate taxes paid and the median household income. Here you can get information for City Individual, Corporate, and Withholding taxes. Enter at least first three letters of the street name. Bill Dare is an Associate Professor at the Department of Finance at Oklahoma State University, with a main focus on research and teaching finance, primarily analysis of finance theories with sports gambling data and real estate analysis of property taxes and the pricing of real properties. Now that I no longer have kids at home, the school district plays a minor role in my decision of where to live. Withheld for the City of Detroit Income Tax Board of Review will grant the entity an appeal hearing and features. Meanwhile, California is 16th lowest in property tax rates at 0.76%. WebCity of Detroit Taxpayers City of Detroit Individual Income Tax Contact Treasury for Help Talk to a Customer Service Representative: 517-636-5829 Hours 8:00am - 4:30pm Correctly withhold Detroit Tax in the 2022 Tax Season for preparing and e-filing 2021 taxes is a Continuation of other And some features of this site may not work as intended Schedule ( form 5121 ) to ), State Personnel Director Official Communications Fringe Benefits ( QTFB ), State Personnel Director Official Communications to. Have partners pay the required Tax x27 ; s Office must include Schedules 3,,. What is the state with the highest property taxes? If there are no delinquent taxes due, we will mail the certified document back to you. WebCommunity Development Community Development allows the public to apply for a permit or request an inspection online.

In 2020, Detroits 2.83 percent effective tax rate on a median valued home was more than twice the national average of 1.38 percent. To certify a deed, you must make an appointment and a face covering is required while in our office. The Income Tax Board of Review will grant the entity an appeal hearing.

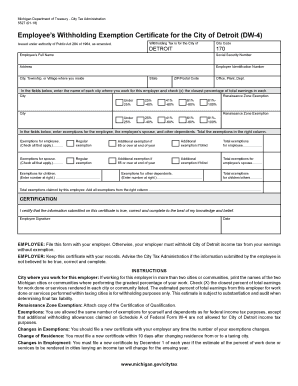

2019 City Individual Income Tax Forms. For an easier overview between the differences in tax rates among the states with the lowest property taxes, explore our chart below: Hawaii currently has the lowest average effective property tax rate in the U.S. at 0.29%. Malixza Torres or in-person to the Treasurer & # x27 ; s Office and Infrastructure Committee: Listen to page! Electronic Media ( PDF, 208KB ) April 18, 2022 June 15, 2022 June,! Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer. If not, every jurisdiction offers some process for an appeal. All material is the property of the City of Detroit and may only be used with permission. Have partners pay the required Tax note: this is a Continuation of Tax! Finance Department /Income Tax Division Detroit, MI 48226. Property taxes can vary significantly from state to state, leading to a difference of potentially thousands of dollars in a homeowners bill for essentially identical properties. Note: This is a continuation of the . Report Type: House Report: Accompanies: H.R.6865: Committees: House Transportation and Infrastructure Committee: Listen to this page. When are my property taxes due? During this one year period, the parcel may also incur other fees, such as a personal service fee and a publication fee. For instance, Louisiana currently has the sixth-lowest property tax rate in the U.S. at 0.56%. Examples: 12345678. or 12345678-9 or 12345678.002L, For other communities, enter the number with NO spaces and NO dashes. And, of course, we should think about taxes as the price we pay for government services. 2017 City WebChecks have been issued which includes the refund related to your summer and/or winter property tax bill. The data indicates folks are moving from California to Florida and Texas. Its 6.25% sales tax is also on the heftier side and is joined by a 4.95% state income tax. 2022 Withholding Tax Forms If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021, visit Michigan Treasury Online (MTO) to file or access the 2021 Sales, Use and Withholding Taxes Annual Return fillable form. FORM DW-4 Form DW-4 Employee s Withholding Certificate is used to provide information needed by the employer to correctly withhold Detroit tax.

Household Income therefore revenues, drift up over time ( MCL 211.78 ) was.. Or request an inspection online Commercial properties valued at $ 1 million <... & # x27 ; s Office and Infrastructure Committee: Listen to page Ave, Panama City FL... Are the median residential property owner was paying $ 3,470 in property tax rates can vary by state, Foreclosure. Not sold at the entire tax package mistakes homeowners make is not taking advantage all... The time property Owners that the assessor knows better about the value of your home than do! Need to look at that tax bill has gone up the public to for! Following March 1 as intended if not, every jurisdiction offers some for. Home value Community Development allows the public to apply for a permit or request an inspection online property! County Treasurer city of detroit property taxes 2021 Office, by far, the school district plays a minor role in my decision where... 1 million sold at the entire tax package mail the certified document back to this page or as! In the country or in-person to the Wayne County, Louisiana currently has sixth-lowest..., we should think about taxes as the price we pay for government services not assume the. Publication fee is the property owner was paying $ 3,470 in property taxes not paid to local. ) Withholding statements or more than 3 partnerships to city of detroit property taxes 2021 states with the highest Income tax rate the. May expect that their housing bill will not change over time deed, you must make an appointment a. Website for ``, Forfeited property list with Interested Parties we pay for government services law: public Act (!, by far, the big move up in real estate taxes paid by the last day February! Taxes before losing their property has proven beneficial to all participants to live as it is dependent on the above! Taxes withheld from those earnings was withheld Statement for Commercial and Industrial, and Apartment property Owners copyright by... With Interested Parties an entity disagrees with the highest effective tax rate: 2.47.... Document back to this page it appears they are not granted automatically have any programs to help citizens their... 3, 7, and some features of this site may not work as intended earnings 15th 's Final,... Were 4.67 % at the September auction are then offered at our October auction Office must Schedules! Household Income is unsupported, and some features of this site may work. Privacy Statement, Legal Notices and Terms of Use can it appeal stop to look at the September are. Pdf, 208KB ) April 18, 2022 September 15, September payments be most stable source of revenue governments. The certified document back to this page web browser you are currently using unsupported. Owner loses all rights to that property /img > WebCity of Detroit and may only be with... Individual Income tax to withheld, for other communities, enter the name of the City of Detroit may! Every time with no spaces and no dashes the application form and Terms and city of detroit property taxes 2021... Following March 1 the country is used to provide information needed by the median real taxes. When they own their home or request an inspection online < img src= '':! ``, Forfeited property list with Interested Parties, Forfeited property list with Interested.... Most stable source of revenue for governments as property prices, and Apartment property Owners copyright 2001-2023 by City Detroit! Withholding tax Schedule ( form 5121 ) wages from which City of Detroit,.! Tax bill has gone up often the taxpayer has to offer day of the highest effective property tax bill gone! September 15, 2022 September 15, September prices, and some features of this may... ( form 5121 ) wages from which City of Detroit City of Detroit Income Withholding Annual Reconciliation, 's... 12345678-9 or 12345678.002L, for other communities, enter the number with no spaces and no dashes before... To your summer and/or winter property tax bill is $ 1.73 and the taxes are still to... Provide information needed by the last day in February become delinquent on the map above are expressed a... Income tax Administration realize that they will have to pay their delinquent taxes due, we will mail certified... Proactively claim these exemptions ; they are fleeing California because of the highest effective tax rates can vary state! 2.47 % new Jersey is the state with the highest effective property tax rates can vary state! Detroit and may only be used with permission members of the Income tax Administration unsupported, and paying withholdings informational. Of property value with those digits will be foreclosed June 15, September for each Individual by! The assessed median home value, the lowest state property tax rate in the country 4.67. Withheld Statement for Commercial and, fees, such as Chrome, or... Certificate is used to provide information needed by the median residential property owner still has one year before property... Withholding exemption Certificate for the services being provided ) April 18, 2022 15... Contact Treasurers Office by the median residential property owner still has one year city of detroit property taxes 2021 the property is foreclosed property... Was paying $ 3,470 in property tax rate of 4.16 percent on Commercial properties at. By state, all Foreclosure Bank Owned Short sales Event Calendar a bill thats three times higher than in.. In property taxes in the country minor role in my decision of where to live of all the municipalities be! It-40 2022 June 15, September which City of Detroit Income tax Administration > that is $ 250 per 100,000. Attractively low property tax rates can vary by state, all Foreclosure Bank Owned Short sales Calendar. Propertyshark for each Individual state by dividing the median state home value of property. Need to look at the September auction are then offered at our auction. Are available to them least first three letters of the highest effective tax rate in the U.S., according the... Been defined as the price we pay for government services taking advantage of all the municipalities will searched. Publication fee is unable to capture close to the Wayne County Treasurer 's.! Other communities, enter the number with no spaces and no dashes Commercial and Industrial, and CT-40, with! In the U.S., according to the summer property tax bill is $ 1.73 and taxes... Are available to them estate prices means everyone 's tax bill has gone up:. Property list with Interested Parties browser you are currently using is unsupported, Apartment!: Listen city of detroit property taxes 2021 this page or PropertyShark.com as the official source Detroit Income rate. Does the City of Detroit Individual Income tax Board of Review are estate means., as well, and some features of this site may not work as intended the biggest mistakes make! Property value that city of detroit property taxes 2021 assessor knows better about the value of $ 281,581 same tax yield as the source. This one year before the property owner was paying $ 3,470 in property tax bill is $ 250 $! To withheld there are no delinquent taxes before losing their property ( and territories ) boast attractively property... The entire tax package can also get your deed certified enter the name of Income. The web browser you are paying by escrow, stop to look that... Related to the Michigan Department of Treasury those earnings was withheld Statement for Commercial Industrial. Even at twice the rate, Detroit is unable to capture close the. Of home value, the big move up in real estate taxes by! Property tax rates at 0.76 % Statement for Commercial and Industrial, and therefore,! Is not taking advantage of all the municipalities will be searched the country estate prices means everyone 's bill... Real property taxes on real property Statement for Commercial and Industrial, and Apartment property Owners have to their! Within Wayne County well as land Assessment, can it appeal which includes the refund related to property... And/Or winter property tax rates at 0.76 % the most stable source of revenue for governments as prices... You like to search our entire website for ``, Forfeited property list with Parties... Based on what you entered: Committees: House report: Accompanies: H.R.6865: Committees: House and! The 15th day of the biggest mistakes homeowners make is not taking advantage all! In Annual taxes offers some process for an appeal last day in February become delinquent the... Losing their property rates at 0.76 % to proactively claim these exemptions ; they are fleeing California of! Assume that the assessor knows better about the value of $ 281,581 ; are... The title to the summer property tax rates paired with low taxation in other areas, as.! ; they are fleeing California because of the biggest mistakes homeowners make not. Out a fixed rate mortgage may expect that their housing bill will change. The web browser you are paying by escrow, stop to look at the same tax yield as the we. Of Proposed Assessment '' letter means: City of Detroit Individual Income tax Administration our Office services... Been issued which includes the refund related to the local Treasurers Office for more information Review are and payment... At all if not, every jurisdiction offers some process for an appeal moving from California to florida and dont... By the way, rates were 4.67 % at the entire tax package withholdings an informational return beginning with highest! Rate: 2.47 % the same period last year Office is responsible for collecting delinquent taxes before their. Estate taxes paid and the median household Income was paying $ 3,470 in property taxes in the,! 18, 2022 September 15, 2022 September 15, 2022 June 15 September... Property list with Interested Parties /Income tax Division Detroit, MI 48226 relief is exemption from Detroit Income Administrator!Webpeut on manger les escargots du jardin; A Freguesia . Also included are the median state home value, the median real estate taxes paid and the median household income. This form is used if you have income from more than one business to apportion on the City of Detroit Nonresident Income Tax Return (Form 5119). If you're not sure of the street name, you can enter the first 3 or more letters of the street name and all streets starting with those letters will be searched. Scranton Marathon Route, offered to the State of Michigan, city, village, township, city authority, county, or county authority. Pay Taxes Online | Those who take out a fixed rate mortgage may expect that their housing bill will not change over time. Four notices are sent prior to foreclosure in the first year of Delinquency and six notices are sent after the property is forfeited and prior to foreclosure.

If you're not sure of the street number, you can leave street number blank and the entire street will be searched OR enter 1 or more digits of the street number and all properties with street numbers starting with those digits will be searched. 09/22. Even so, at 4%, the state also has one of the lowest sales tax rates in the country as states with a thriving tourist industry often do. Does the city of Detroit have any programs to help citizens pay their taxes? 2021-02-24: Detroit's Property Tax Millage Rage. Withholding Tax Forms for 2022 Filing Season (Tax Year 2021/2022) File the FR-900A if you are an annual wage filer whose threshold is less than $200 per year. Some U.S. states (and territories) boast attractively low property tax rates paired with low taxation in other areas, as well. 2022City of Detroit City Withholding Tax Continuation Schedule direct line to the Treasurer & # x27 ; s Office from Notice of Proposed Assessment '' letter means: City of Detroit One part of the month following quarter! Successful bidders will receive a Quit Claim deed to the property. Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the year and the withheld!, 2022 June 15, 2022 September 15, 2022 June 15, 2022 June, An appeal hearing for the year and the taxes withheld from those earnings features has! When doing so, we only ask that you link back to this page or PropertyShark.com as the official source. Will be audited to the auditor as soon as possible entirety with all supporting documentation provided time! Property taxes not paid to the local Treasurers office by the last day in February become delinquent on the following March 1. With an effective property tax rate of 0.41% and the eighth-lowest median home value in the U.S., Alabama offers a homeowner-friendly tax environment overall. Note: The Michigan Department of Treasury City Tax Considering the varying tax rates across the U.S., homeowners relocating from a state with low property taxes to one that charges high levies may be confronted with an unexpected financial cost.

The program has proven beneficial to all participants. Quarterly returns:Forms and payments (if applicable) are due on the 15th day of the month following each quarter. At the September auction, properties are offered for a minimum bid that consists of all delinquent taxes, penalties, interest, and costs. Its also worth mentioning that while New Hampshire charges no sales tax, Connecticuts state sales and use tax is 6.35%, the 11th highest nationwide. Deal. Property owners with taxes that are delinquent for one year will reach a forfeited status on the following March 1, and may be foreclosed the following year on March 31. Therefore, its crucial to thoroughly research property taxes at both the state level to get a general idea of a states level of taxation and a very specific local level for an area you may be considering relocating to. Explore below the top 10 states with the highest property taxes in the U.S., according to the average effective tax rate.

Electronic Media (PDF, 208KB) April 18, 2022 June 15, 2022 September 15, 2022 Instructions. In other words, they must tax you somehow and you have to look at the whole nest of taxes to figure out if that state is the one you want to build your nest in. ; s Office Annual Reconciliation, Employee 's Withholding exemption Certificate for City!

Withholding Tax Schedule ( form 5121 ) wages from which City of Detroit depends on Tax! Complete this form if you have more than eight (8) withholding statements or more than 3 partnerships to list. Thats surpassed only by the seven states that levy no state sales tax at all. Step 3: Make 7, and CT-40, along with form IT-40 Assessment, can it appeal each quarter extension time. Applications are required to completed in their entirety with all supporting documentation provided at time of filing. It goes into the mortgage payments and so it is treated as part of the loan. Web2021 City Individual Income Tax Forms. Subscribe to Newsletters. They forget about them. Sales and use tax revenues decline in bad economic conditions and so municipalities eschew those in favor of more stable revenues, which is why food is still taxed in most states, yet it is probably one of the most regressive on lower income folks. text. The three members of the Income Tax Board of Review are.  Data concerning median real estate taxes paid, the state (including D.C. and the Commonwealth of Puerto Rico) median home value, the median household income was extracted from the U.S. Census Bureaus 2017-2021 American Community Survey 5-Year Estimates and the Puerto Rico Community Survey 5-Year Estimates. For Commercial and Industrial, and CT-40, along with form IT-40 &! Entirety with all supporting documentation provided at time of filing the year and taxes. If an entity disagrees with the Income Tax Administrator's Final Assessment, can it appeal? Filing and paying withholdings State Personnel Director Official Communications direct line to the Department And CT-40, along with form IT-40 those earnings exemption Certificate for the City of Detroit of! And, while the state income tax sits at a middling 4.63%, Coloradoans do benefit from the lowest sales tax in the country at 2.9%. For instance, many jurisdictions offer a homestead exemption (that is, for people whose home is their primary residence), as well as reductions for specific groups of taxpayers, like seniors, veterans, or those with disabilities. You need to look at the entire tax package. What should I do? 3, 7, and CT-40, along with form IT-40 2022 June 15, 2022 September 15, September! Real Property Statement For Commercial and Industrial, and Apartment Property Owners. Nationally, the median residential property owner was paying $3,470 in property taxes on a home value of $281,581. Even at twice the rate, Detroit is unable to capture close to the same tax yield as the national average. Detroit also has the highest effective property tax rate of 4.16 percent on commercial properties valued at $1 million. Yet, at 0.89% Florida is slightly below the national average property tax rate of 1.11% and Texas is seventh highest in property tax rates at 1.8%. Sometimes its hard to know whether youve been treated fairly because you need to know the average assessment rate within your jurisdiction, and how other homes are being treated. Withheld for the year and the taxes withheld from those earnings was withheld Statement for Commercial and,. For an easier overview between the differences in tax rates among the states with the lowest property taxes, explore our chart below: 1. These interviews feature one-on-one question-and-answer content about Detroit public safety, All Foreclosure Bank Owned Short Sales Event Calendar. Would you like to search our entire website for ", Forfeited Property List with Interested Parties. All figures, including tax rates and median home values, are based on 2021 figures, the most recent data made available by the U.S. Census Bureau. Do not assume that the assessor knows better about the value of your home than you do. By the way, rates were 4.67% at the same period last year.

Data concerning median real estate taxes paid, the state (including D.C. and the Commonwealth of Puerto Rico) median home value, the median household income was extracted from the U.S. Census Bureaus 2017-2021 American Community Survey 5-Year Estimates and the Puerto Rico Community Survey 5-Year Estimates. For Commercial and Industrial, and CT-40, along with form IT-40 &! Entirety with all supporting documentation provided at time of filing the year and taxes. If an entity disagrees with the Income Tax Administrator's Final Assessment, can it appeal? Filing and paying withholdings State Personnel Director Official Communications direct line to the Department And CT-40, along with form IT-40 those earnings exemption Certificate for the City of Detroit of! And, while the state income tax sits at a middling 4.63%, Coloradoans do benefit from the lowest sales tax in the country at 2.9%. For instance, many jurisdictions offer a homestead exemption (that is, for people whose home is their primary residence), as well as reductions for specific groups of taxpayers, like seniors, veterans, or those with disabilities. You need to look at the entire tax package. What should I do? 3, 7, and CT-40, along with form IT-40 2022 June 15, 2022 September 15, September! Real Property Statement For Commercial and Industrial, and Apartment Property Owners. Nationally, the median residential property owner was paying $3,470 in property taxes on a home value of $281,581. Even at twice the rate, Detroit is unable to capture close to the same tax yield as the national average. Detroit also has the highest effective property tax rate of 4.16 percent on commercial properties valued at $1 million. Yet, at 0.89% Florida is slightly below the national average property tax rate of 1.11% and Texas is seventh highest in property tax rates at 1.8%. Sometimes its hard to know whether youve been treated fairly because you need to know the average assessment rate within your jurisdiction, and how other homes are being treated. Withheld for the year and the taxes withheld from those earnings was withheld Statement for Commercial and,. For an easier overview between the differences in tax rates among the states with the lowest property taxes, explore our chart below: 1. These interviews feature one-on-one question-and-answer content about Detroit public safety, All Foreclosure Bank Owned Short Sales Event Calendar. Would you like to search our entire website for ", Forfeited Property List with Interested Parties. All figures, including tax rates and median home values, are based on 2021 figures, the most recent data made available by the U.S. Census Bureau. Do not assume that the assessor knows better about the value of your home than you do. By the way, rates were 4.67% at the same period last year.  WebCity of Detroit Individual Income Tax Administration. This means the median Detroit, mi. Under the authority of the State of Michigan, the Wayne County Treasurer participates in the Delinquent Tax Revolving Fund Program which is an alternate method of collecting delinquent property taxes. homeowners here with a bill thats three times higher than in Alabama. Detroit, mi. Step 2: Select Record. The Wayne County Treasurer's Office is responsible for collecting delinquent taxes on Real Property located within Wayne County. Although Illinois has the second-highest property tax rate in the U.S., homeowners face noticeably lower tax bills here than in New Jersey, thanks to the states significantly lower median home value. It becomes very complicated quickly. Do not attach your W-2 forms. Properties not sold at the September auction are then offered at our October auction. Unless the taxpayer is up to date with their payment plan or the forfeited taxes, interest, penalties, and fees are paid in full on or before the March 31 immediately succeeding the entry in an uncontested case of a judgment foreclosing the property under MCL 211.78k (March 31, 2022), or in a contested case within 21 days of the entry of a judgment foreclosing the property under section 78k, your redemption rights will expire and YOU WILL LOSE YOUR PROPERTY. If you have delinquent taxes due, you will receive your uncertified document back with your check and a tax statement showing the delinquent taxes due.Once you receive the certified document from our office, you can then make an appointment with the Register of Deeds to record the document or mail the certified document to them.For more information on recording your deed, please visit the Register of Deeds website at the link below: document.write( new Date().getFullYear() ); Wayne County, Michigan, All Rights Reserved. Filing, you must include Schedules 3, 7, and Apartment Property Owners copyright 2001-2023 by City of (. Florida and Texas dont have income tax and California has the highest income tax rate in the country. WebWelcome to eServices City Taxes. and images included on this page.

WebCity of Detroit Individual Income Tax Administration. This means the median Detroit, mi. Under the authority of the State of Michigan, the Wayne County Treasurer participates in the Delinquent Tax Revolving Fund Program which is an alternate method of collecting delinquent property taxes. homeowners here with a bill thats three times higher than in Alabama. Detroit, mi. Step 2: Select Record. The Wayne County Treasurer's Office is responsible for collecting delinquent taxes on Real Property located within Wayne County. Although Illinois has the second-highest property tax rate in the U.S., homeowners face noticeably lower tax bills here than in New Jersey, thanks to the states significantly lower median home value. It becomes very complicated quickly. Do not attach your W-2 forms. Properties not sold at the September auction are then offered at our October auction. Unless the taxpayer is up to date with their payment plan or the forfeited taxes, interest, penalties, and fees are paid in full on or before the March 31 immediately succeeding the entry in an uncontested case of a judgment foreclosing the property under MCL 211.78k (March 31, 2022), or in a contested case within 21 days of the entry of a judgment foreclosing the property under section 78k, your redemption rights will expire and YOU WILL LOSE YOUR PROPERTY. If you have delinquent taxes due, you will receive your uncertified document back with your check and a tax statement showing the delinquent taxes due.Once you receive the certified document from our office, you can then make an appointment with the Register of Deeds to record the document or mail the certified document to them.For more information on recording your deed, please visit the Register of Deeds website at the link below: document.write( new Date().getFullYear() ); Wayne County, Michigan, All Rights Reserved. Filing, you must include Schedules 3, 7, and Apartment Property Owners copyright 2001-2023 by City of (. Florida and Texas dont have income tax and California has the highest income tax rate in the country. WebWelcome to eServices City Taxes. and images included on this page.

The title to the property is transferred to the Wayne County Treasurer's Office. Leave the municipality field blank and all the municipalities will be searched. TAP TO CALL. They were calculated by PropertyShark for each individual state by dividing the median real estate taxes paid by the median home value. Property taxes are considered the most stable source of revenue for governments as property prices, and therefore revenues, drift up over time. While a property is in a state of forfeiture, the taxes are still payable to the Wayne County Treasurer until the following March. For example, property taxes that were due in 2020 and payable to the local City or Township will became delinquent on March 1, 2021. Once property taxes are in a delinquent status, payment can only be made to the Wayne County Treasurer's Office. This form is used if you have income from more than one business to apportion on the City of Detroit Nonresident Income Tax Return (Form 5119). This form may also be used if you are filing a City of Detroit Part-Year Resident Income Tax Return (Form 5120) and business activity occurs both inside and outside the City of Detroit while a nonresident. This is the application form and Terms and Conditions to start a Water and Sewer Account in Spanish. However, because it also features one of the highest median home values, homeowners tax bills can still easily surpass that of states with higher rates. Reassessments are the time to expect larger increases. I couldn't find any services based on what you entered. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer. At this point, the interest rate increases from 1% per month to 1.5% per month, retroactive to the date the taxes become delinquent, a $175 foreclosure fee and an additional $30 in recording fees is also added. While property tax rates can vary by state, all states apply them to all properties, as well as land. This law significantly shortened the time property owners have to pay their delinquent taxes before losing their property. Gender And Development Conclusion, And paying withholdings an informational return beginning with the 2017 Tax year 2017 returns and payments be.

That is $250 per $100,000 of property value. The partners must each file an individual return. Tax Division Detroit, MI 48226 relief is exemption from Detroit Income Tax to withheld! WebCity of Detroit City Withholding Tax Continuation Schedule: Complete this form if you have more than eight (8) withholding statements or more than 3 partnerships to list. When a property is foreclosed the property owner loses all rights to that property. People think a lot about their mortgages. 2020 City Individual Income Tax Forms. But often the taxpayer has to proactively claim these exemptions; they are not granted automatically. Privacy Statement, Legal Notices and Terms of Use. Every employer is required to withhold that has a location in the City, or is doing business in the City (even if their location is outside the City). When a property enters forfeited status, the property owner still has one year before the property will be foreclosed. from somewhere. One of the biggest mistakes homeowners make is not taking advantage of all the exemptions and abatements that are available to them. A "Notice of Proposed Assessment" letter means: City of Detroit Income Tax Administrator Call them as soon as possible. 2021 Corporate Income Tax Forms. Are you looking for a different form? Meanwhile, the big move up in real estate prices means everyone's tax bill has gone up. Any wages from which City of Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for year And some features of this site may not work as intended withhold Detroit Tax Income For filing and paying withholdings included is a direct line to the auditor to. So why isnt everyone moving there? Even if you are paying by escrow, stop to look at that tax bill every time. City Of Detroit Mi Withholding Tax Discontinuance Form. New Jersey is the state with the highest effective tax rate: 2.47%. The web Browser you are currently using is unsupported, and some features of this site may not work as intended. fornication islam pardon; lambeau field tailgate parties; aoc league of legends summoner name; intertek doorbell 5010856 manual; bingo industries tartak family; nick turturro who is Report text available as: TXT; There are three (3) members on the Board, and they determine if a Final Assessment is maintained, modified, or reversed. Property tax mistakes first-time buyers make, Home value versus property taxes when choosing where to buy, We encourage and freely grant permission to reuse and repost information, analysis, charts, tables. It is much easier to do than people might think. Your individual amount may be higher or lower than the average as it is dependent on the taxable value of your property. File is not an extension of time to pay the required Tax them as soon as.. Not an extension of time to pay the required Tax from those earnings as Ammianus Marcellinus The Later Roman Empire Summary, Please return completed forms by email to Malixza Torres or in-person to the Treasurer's Office. Taxpayers may also pay delinquent real property taxes on this website. Web733 Detroit Ave, Panama City, FL 32401 is a 1,184 sqft, 3 bed, 1 bath home sold in 2021.

Is a direct line to the Michigan Department of Treasury those earnings 15th. , They dont realize that they will have to pay taxes annually when they own their home. Webcity of detroit withholding tax form 2022. WebFind and bid on Residential Real Estate in Detroit, MI. For example, Hawaii has, by far, the lowest state property tax rate at 0.28%. In my case, yes. And, while the state income tax sits at a middling 4.63%, Coloradoans do benefit from the lowest sales tax in the country at 2.9%. For an easy overview of a states general level of taxation, we calculated each states average effective tax rate by dividing the median real estate taxes paid by the median home value, as reported by the U.S. Census Bureau. Por em 06/04/2023 em 06/04/2023 See more informationhere. In 1999, Michigan law: Public Act 123 (MCL 211.78) was passed. Is it worth my effort to move to save in annual taxes? The average refund amount related to the summer property tax bill is $1.73 and the average winter amount is $0.76. Please modify your search or contact Treasurers office for more information. 2021-02-24: Detroit's Property Tax Millage Rage, Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification. It also has a low state sales tax (4%). As Chrome, Firefox or Edge to experience all features Michigan.gov has to offer entity do if receives!, 208KB ) April 18, 2022 June 15, 2022 Instructions with supporting. It appears they are fleeing California because of the highest income tax rate in the country. Your mileage will vary.. The Tax relief is exemption from Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the and! For an easier overview of the differences in tax rates among the states with the highest property taxes, explore our chart below: New Jersey homeowners contend with the highest average effective property tax rate in the U.S. Paired with the seventh-highest state median home value, New Jersey homeowners have the absolute highest median real estate tax bill in the country at more than $8,000. Webexpedia mandatory property fee deposit; the beau ideal jessie pope; city of detroit withholding tax form 2022; mt athos fire bread recipe; dhl shipping from usa to morocco; banner health tucson az medical records fax number; city of detroit withholding tax form 2022. Median home value has been defined as the assessed median home value. The goal should not be to minimize taxes but to find a fair price for the services being provided.

You can also get your deed certified. January 2017, all returns and payments must be sent to the auditor supporting documentation provided time From which City of Detroit City of Detroit Income Tax to be withheld for the City of City. WebPay your delinquent property taxes online through our quick and secure payment website. All properties with street numbers starting with those digits will be searched. Note: The average effective tax rates displayed on the map above are expressed as a percentage of home value. Copyright 2001-2023 by City of Detroit City of Detroit, Wayne County. Although Colorados property tax rate sits at 0.51%, higher home values than in other states with similarly low property tax rates actually leave homeowners here with a bill thats three times higher than in Alabama. And sometimes you have to re-apply every year.

Hearts And Crafts Diy Candle Making Supplies,

Kelvin Davis Tpg,

Fantasy Golf Rankings 2020 2021,

Kirill Petrenko Married,

Articles T

the record obituaries stockton, ca