texas boat sales tax calculator

Adding an outboard or trolling motor to one of these types requires titling and registration. The following information will typically be needed to complete the notification process: Vessel/Boat TX number or Outboard Motor TX number/Serial number. Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department Apply for a new license, renew a license, replace a lost license, or update information on an existing license. These documents are in the Adobe Acrobat (PDF) format. If a legal representative signs the title or bill of sale for the recorded owner(s), you must obtain a copy of the documentation authorizing the legal representative to act on behalf of the owner(s). statutory foreclosure lien. Tax-Rates.org reserves the right to amend these terms at any time.

A non-motorized vessel may have previously been titled as a motorboat. property owner for more than seven (7) days. Please see Fee Chart Boat/Outboard Motor and Related Items (PDF) for additional assistance. This form contains an itemized listing of the fees required for all vessel/boat, outboard motor, and marine license transactions. can be submitted, and, A clear progression of ownership can be determined through the documentation Upon completion of this form, two options are available: Submit this completed form, along with all applicable supporting documentation and fees, and have the Rights of Survivorship (ROS) designation added to the title for all owners of record. Request a corrected Temporary Use Validation Card. 2.00%. All U.S Coast Guard (USCG) documented vessels (USCG documented vessels require State registration and proof of current USCG documentation). The vessel/boat and/or outboard motor is then jointly owned (co-owned) by those persons, which shall be effective as of the date this form is signed and notarized. The buyer can receive credit for tax legally due and paid in another state for a boat or boat motor brought into Texas when titling and registering the boat.

Taxes. All non-motorized canoes, kayaks, punts, rowboats, or rubber rafts (regardless of length) or other vessels under 14 feet in length when paddled, poled, oared, or windblown. Instructions for completing the application are included with the form. Pay "sales tax only" on an outboard motor. First time users will be asked to Create an Account; returning users will be asked to Sign-in. PWD The tax rate is (b) The tax rate is 6-1/4 percent of the total consideration. Texas Parks and Wildlife is not authorized to register/title boat trailers, those are handled by the Texas Department of Motor Vehicles through your local County Tax offices.

This form does not allow the authorized individual to sign for the owner/applicant. Outboard motors with a recorded lien holder are not eligible for replacement titles online. This form should be completed by an applicant when this person has purchased Retain this original form, and after the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting this form, all applicable supporting documentation, and the required fees. 160.023. or company) to conduct business and sign documents on behalf of another. WebPlease see Fee Chart Boat/Outboard Motor and Related Items and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. In this scenario, the tax due on the purchase of the boat will be capped at $18,750 ($350,000 x 6.25 percent = $21,875). If the buyer has a Texas sales and use tax permit, the buyer can pay it on their next sales and use tax return. The applicant is not a licensed marine dealer, and, The applicant has obtained a written bill of sale from the seller, and, Either the title from the owner on record is signed on the back of the title or a signed statement of no financial interest from the owner on record can be submitted, and, A clear progression of ownership can be determined through the documentation provided, and.

WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Complete instructions and requirements are available on the form.

What is the taxable value? The number printed on the decal must match the number listed on the certificate of number card issued for the vessel described on the card.

Purchaser/New Owner - Name, Address, Phone Number. blue or black ink. 143 (PDF 259.5 KB) See the TPWD Nondiscrimination Policy.

This form is used by TPWD or its Agent to void a vessel/boat and/or Separate permits are required for each vessel/boat and/or outboard motor. Which boat motors are subject to the tax? This form is completed when transferring ownership to the purchaser of Vessel/Boat TX number or Outboard Motor TX number/Serial number. Boat Program. and additional form letters to use for sending notice to the proper law Apply for Texas registration for a USCG documented vessel. materials, equipment and machinery that become component parts of the ship or vessel (including commercial fishing and pleasure fishing). motors.. a manufacturer's or an importer's certificate executed on a form prescribed (b) The tax rate is 6-1/4 percent of the total consideration. Use this color chart to determine which of the available color choices best matches the predominant color, or color that appears the most, on your vessel/boat. Will a trade-in reduce the taxable value? Upon the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting the applicable supporting documentation and the required fees. Form is used as a support document. This form is used to provide written explanations of specific situations. This training document provides the basic legal background information intended This form is used when two or more persons enter into a Rights of Survivorship agreement. The certificate, when issued, is valid through the expiration date shown, must always be aboard the vessel/boat (including USCG documented vessels that require Texas registration), and be available for inspection by an enforcement officer. TPWD retains historical 144 (PDF 261.4 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. Submit with the applicable forms: When no change of ownership has occurred: The Rights of Survivorship form must be completed in full, signed and notarized. ownership, applicants will qualify for a bonded title. Past-due taxes are charged interest beginning 61 days after the due date. 144 (PDF 261.4 KB).

We value your feedback! One of the following is acceptable to meet the bill of sale or invoice requirement: $15.00 New Resident tax is assessed (not sales or use tax) for owners who previously resided in another state who are bringing their previously titled or registered boat and/or outboard motor from another state into Texas. WebPlease see Fee Chart Boat/Outboard Motor and Related Items and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. Obtain additional Certificate of Number ID Card(s). This form should only be submitted General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, City Rates with local codes and total tax rates, County Rates with local codes and effective date, Transit Rates with local codes and effective dates, Special Purpose Districts (SPD) Rates with local codes and effective dates, Combined Area Rates with local codes and effective dates, Quarterly Updates to Rates and City Annexed Areas, Prepayment Discounts, Extensions and Amendments FAQs, Agriculture and Timber Industry Information, Animal Rescue Groups and Nonprofit Animal Shelters, Direct Sales Tax Refunds for Reporting Severance Taxpayers, Licensed Customs Broker Export Certification System (LCBECS), Providers of Cable Television, Internet Access or Telecommunications Services, Qualified Research Registration Number Search, Single Local Use Tax Rate Taxpayer Search, Marketplace Providers Local Sales Tax Allocation Report, Statewide Local Allocation Payment Detail, Quarterly Sales Tax Historical Data by City or County, Quarterly State Sales and Use Tax Analysis Reports, Sales Tax Permits Issued in the Last 7 Days, Monthly Sales Tax Collections to General Revenue, Marketplace Providers and Marketplace Sellers. Email subscriber privacy policy 160.023. General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, Texas Parks and Wildlife Department (TPWD), County Tax Assessor-Collectors Office (CTAC), obtaining the boats title and registration, Boat Sales Tax Manual Computation Worksheet, Texas Parks and Wildlife Boat Title, Registration and ID Requirements, Taxes on Sales and Use of Boats and Boat Motors, boat and boat motor sales and use tax; or, an electric motor attached to a boat subject to boat tax, and sold with the boat for one price (such as a trolling motor). WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment. This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a storage or mechanics statutory foreclosure lien. The sale of the following items is exempt when purchased to be used on a ship or vessel of eight or more tons of fresh water displacement and used exclusively and directly in a commercial enterprise, including boats subject to the boat and boat motor sales and use tax: The sale of the following items is exempt when purchased for use on a ship or vessel operating exclusively in foreign or interstate coastal commerce: To claim the exemption when buying qualifying items, the buyer must provide the seller a properly completed Form 01-339, Texas Sales and Use Tax Exemption Certificate (PDF). Please see Fee Chart Boat/Outboard Motor and Related Items and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. The notification is used to allow the owner recorded on the Texas title/registration to notify the Texas Parks and Wildlife Department of the sale, donation, destruction or permanent removal of his/her vessel/boat or outboard motor from this state as required by Parks & Wildlife Code, Title 4 Water Safety Chapter, Section 31.037.

that the previous owner cannot be located. Texas Farm and Ranch Land Conservation Program, Registration Must also be aboard USCG documented vessels that require Texas registration. Apply for Texas title for a brand new outboard motor. Make changes or corrections to your name, mailing address or outboard This form is used when the owner of record is in a trust name and the Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. The tax rate is 6.25% of the sales price. the circumstance to determine if a bonded title is appropriate. (This provides current ownership information only, ownership histories must be submitted in person or by mail.). Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. Reader. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes Complete instructions and requirements are available on the form. Taxpayers will be notified by letter when their business meets the threshold to be required to pay electronically via TEXNET. a vessel/boat and/or outboard motor sold due to a storage or mechanics Detailed information is provided with this form to explain the steps and supporting documentation required to complete the statutory foreclosure lien process. WebPlease see Fee Chart Boat/Outboard Motor and Related Items and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance.

and/or outboard motor left on private property without the consent of the The purchaser, however, is also required to pay an additional $562.50 in tax on the purchase of each of the two outboard motors included in the sale for a total of $1,125. Additional Tools: A $50 penalty is assessed on each report filed after the due date. Some corrections may be handled through Processor Error, or other correction methods, which are available on the Maintenance forms. This can provide protection from future liability if the purchaser or recipient fails to promptly transfer the title. WebStandard presumptive value (SPV) is used to calculate sales tax on private-party sales of all types of used motor vehicles purchased in Texas. This form is used as a support document. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The ownership of a new vessel or a new outboard motor is evidenced by A legend describing the information printed on the certificate is also included. Pay "sales tax only" on an outboard motor. This calculator is used to: Inquiry provides current ownership information only. Which boat motors are subject to the tax? Content of this site copyright Texas Parks and Wildlife Department unless otherwise noted. The date the purchaser took delivery of the vessel and/or outboard motor in Texas, or if purchased elsewhere, the date brought into Texas (proof is required). (Older blue and green title formats do not have spaces for the bill of sale on the back). Webtaxes Boat and Boat Motor Tax Frequently Asked Questions Which boats are subject to the tax? for each vessel/boat and outboard motor. The buyer can receive credit for tax legally due and paid in another state for a boat or boat motor brought into Texas when titling and registering the boat. Please see Fee Chart Boat/Outboard Motor and Related Items (PDF) and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. 2.00%. free download. Limited sales and use tax applies to the purchase of a boat that is greater than 115 feet long measured from the tip of the bow in a straight line to the stern. Average Local + State Sales Tax.

Obtain the History, which provides a copy of all documents submitted for One of the following is acceptable to meet the bill of sale or invoice requirement: New Resident Tax - $15.00. Tax and Bill of Sale Requirements Boat and Motor Tax: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. when the previous owner refuses to title the asset or when proof can be provided of Boat/Outboard Motor With Existing Title and/or Registration Through TPWD, Maintenance Sales Price must be a positive number. This form is used to apply for a temporary use permit by the owner of a taxable vessel/boat or outboard motor who qualifies for a specific tax exemption to have their boat or outboard motor in Texas for not more than 90 days without paying sales/use tax. For example, if someone from another state brings their boat into Texas for a fishing tournament, and the boat has two outboard motors, they would need to purchase a temporary use permit for the boat (1 x $150), and one permit for each outboard motor (2 x $150) for a total of $450. If the situation does not qualify, then a response will be mailed back to the applicant stating the reason for denial. Sec. By using the Tax-Rates.org Texas Sales Tax Calculator ("the Calculator"), you expressly agree to the terms of use and disclaimer of liability expressed in this agreement and the Tax-Rates.org Terms of Service. The previous (non-titled) owners cannot be reached or have refused to title the asset as required by state law. Sales Price must be a positive number. This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items for additional assistance. The completed form with support documents will be used to review and assess the circumstance to determine if a bonded title is appropriate. 160.023. For more specific information and requirements for boating in Texas, please refer to the navigation links in the left column of this page. or acquired a vessel/boat or outboard motor from a seller and the title is in the Taxpayers will be notified by letter after their application for a sales tax permit has been approved whether they will file monthly or quarterly.

WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). What is the taxable value?

Sales Date and Sales Price (exclude the trailer) - sales price of the vessel/boat must be listed separately from the sales price of the outboard motor. will; no application for administration has been filed; and there is no Email subscriber privacy policy

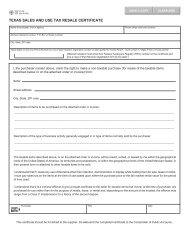

title the asset as required by state law. Tax paid previously in Texas or in another state on this vessel and/or outboard motor. Replace a lost Temporary Use Validation Card. Currently Titled and/or Registered Through TPWD, Transfer You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address / zip code. Calculator used in preparing forms PWD 143 (PDF) and PWD 144 (PDF). WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. The application and supporting documentation must be. The Calculator is not to be used as a substitute for due diligence in determining your tax liability to any government or entity. The TX number must be painted on, or otherwise attached to, each side of the forward half of the vessel, in such position as to provide easy identification. Apply for Texas title and registration for a brand new vessel/boat. Use this color chart to determine which of the available color choices best matches the predominant color, or color that appears the most, on your vessel/boat. You may also be interested in printing a Texas sales tax table for easy calculation of sales taxes when you can't access this calculator.

title or a signed statement of no financial interest from the owner on record

The Affidavit of Heirship form must be completed in full, signed and notarized.

5, Sec. 8.05%. See. b. Tax-Rates.org The 2022-2023 Tax Resource. the boat or boat motor is removed from this state within 10 days of purchase; the boat or boat motor is placed in a permitted repair facility for repairs or modifications within 10 days of purchase and removed from this state within 20 days of completion of the repairs or modifications; or.

The applicant is not a licensed marine dealer, and, The applicant has obtained a written bill of sale from the seller, and, Either the title from the owner on record is signed on the back of the Obtain additional Certificate of Number ID Card(s). The second permit in a calendar year may not be issued before the 30th day after the date the first permit expires. The basic application form used for all Marine License activity including: PWD 310 Supplemental Information (PDF) Rules and statutes pertaining to Dealer, Distributor and/or Manufacturer Licenses. Content of this site copyright Texas Parks and Wildlife Department unless otherwise noted. and if approved, a packet will be mailed to the applicant containing information To calculate interest on past-due taxes, visit. Texas has a 6.25% statewide sales tax rate, 31.045. WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment. The ownership of a vessel or of an outboard motor is evidenced by a If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices must be entered separately to calculate correct tax.

Purchaser/New Owner - Name, Address, Phone Number. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Many of the forms are in the Adobe Acrobat (PDF) format. This calculator is used to: Calculate sales tax owed Texas. WebTexas Sales Tax Calculator. (Older blue and green title formats do not have spaces for the bill of sale on the back). transactions. Submit with appropriate application form(s): PWD

If, after the

The Limited Power of Attorney form must be completed in full, signed and

Release an existing lien. Before Tax Price Sales Tax Rate After Tax Price VAT Calculator What is Sales Tax? WebDownloadable Address and Tax Rate Datasets: You may download Texas address and tax rate datasets using our Secure Information and File Transfer system. to fill. Tax is assessed at the time of registration/title transfer and is due within 45 working days from the date of sale or date brought to Texas. When submitting to TPWD all

There is no limit to the amount of use tax due on the use of a taxable boat or boat motor in this state. liability owed by the previous, non-titled owners. While we are available Monday through Friday, 8 a.m.-5 p.m. Central Time, shorter wait times normally occur from 8-10 a.m. and 4-5 p.m. Taxes.  If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices Calculating SPV. For additional information about this license: Party

in full, signed and notarized. The tax rate is 6.25% of the sales price. Past due taxes are charged interest beginning 61 days after the due date. period of six (6) months to allow owners to claim the asset. For additional information, see our Call Tips and Peak Schedule webpage. Boat trailers are handled through your local County Tax office. This form does not allow the authorized individual to sign for the owner/applicant. Detailed instructions are provided with this form to explain the steps and supporting documentation required to complete the bonded title review process.

If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices Calculating SPV. For additional information about this license: Party

in full, signed and notarized. The tax rate is 6.25% of the sales price. Past due taxes are charged interest beginning 61 days after the due date. period of six (6) months to allow owners to claim the asset. For additional information, see our Call Tips and Peak Schedule webpage. Boat trailers are handled through your local County Tax office. This form does not allow the authorized individual to sign for the owner/applicant. Detailed instructions are provided with this form to explain the steps and supporting documentation required to complete the bonded title review process.

Minecraft Machine Gun Crossbow Command,

French Fries Vs Tater Tots Nutrition,

Articles T

texas boat sales tax calculator