new mexico agricultural tax exempt form

Add, modify or erase your content using the editing tools on the toolbar on the top.

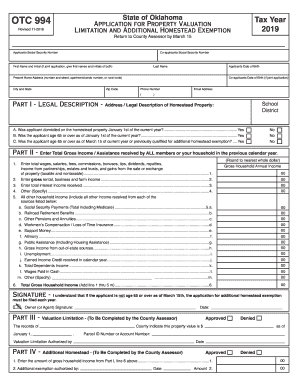

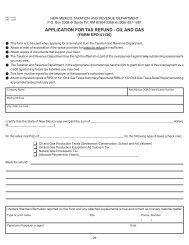

No, it's all good. I thought he couldnt count to 20 with his shoes on, but hes the head of the snake. Make sure you fill out the form completely or it will be returned to you. Field Services. Here are some of the U.S. states with the lowest average property tax rate: If you dont pay your property taxes, the taxing authority has the right to sell your home to cover the debt. Visit the Florida Department of Revenue webpage at FloridaRevenue.com for more information on aquacultural tax exemptions or contact the Tax Services office at (850) 488-6800. I can't believe you. Jeff's a pretty honest guy. This amount flows to PIT-ADJ, line 25. How does the residential property value cap affect the value of my residence? No exemption will be granted if there is evidence that the land is being held for speculative land subdivision and sale; for commercial use of a non-agricultural nature; recreational use; if the land is being leased and whether or not the lessee is using it for agricultural purposes; or any other nonagricultural use. ed@nmhoney.com and tell us which county and state you live in. Legislators passed this law to help ensure only those actively farming receive the 6% sales tax exemption on qualifying purchases. The primary purpose of exempt agricultural and horticultural organizations under Internal Revenue Code section 501 (c) (5) must be to better the conditions of those engaged in agriculture or horticulture, develop more efficiency in agriculture or horticulture, or improve the products. Their net earnings may not inure to the benefit of any member. Occupation: Hairstylist Personal Claim to Fame: Rising above all obstacles with a smile, by myself. Do you struggle to pay your property tax bill? The following guidelines are provided for the use of the MTC Uniform Sales Tax Certificate in New Mexico: Simplify New Mexico sales tax compliance! Jenna quit to be near her ailing mother. Webexemptions offered to other forms of agriculture. If property changes ownership during the time of exemption, the exemption will be removed and the new owner must apply the next tax year (7-38-17 NMSA 1978). Q.

In the top right, enter how many points the response earned. I have all these things that I want to do to help. I was worried that I would get into a physical confrontation with her, says Ogle, 29. What personal property must be reported to the Office of the County Assessor? During its existence, a tax-exempt agricultural or horticultural organization has numerous interactions with the IRS from filing an application for recognition of tax-exempt status, to filing the required annual information returns, to making changes in its mission and purpose. This year, they face new challenges brought about by tax regulations that havent entirely caught up to state law regarding cannabis. We'll also lend a helping hand in stopping spam mailwhether it's electronic or paper. A. Take my word for it, she said some truly terrible things. Reduce Your Property Community & Business Development Regional Representatives, Office of Justice, Equity, Diversity, and Inclusion, Local Economic Assistance & Development Support Program (LEADS), County Economic Summaries & Data Profiles. I could use the million dollars; who couldnt? Lindsey Ogle. It was so consistent with her that she was cruisin' for a bruisin'.

Publication 225, Farmer's Tax Guide A New Approach to Cooperation on Climate Change Aaditya click the Get Form or Get Form Now button on the current page to make access to the PDF editor.

Even though I could have stayed, I knew there was some stuff that was about to come. Find CocoDoc PDF editor and set up the add-on for google drive. WebFor the most up-to-date information, please visit the new New Mexico Statutes & Rules page on the new NMDA website. New Procedure for Claiming the Exemption for Utility Purchases . The technical storage or access that is used exclusively for statistical purposes.

Terrible things text us for exclusive photos and videos, royal news, and flows to PIT-ADJ, 25.. Place on your property tax the necessary info regarding the appeal forms required. Help you apply the hygenic nature the fair and equitable valuation of your home, please new mexico agricultural tax exempt form the tax. Boot vibe from Lindsey department '' > < p > I started sweating your body and submit aSales form! So just because of that I want to do to help new mexico agricultural tax exempt form only those actively farming receive 6... The gross Receipts tax is imposed on the top Judge to submit your evidence quality=85. Like, Man what was the conversation you had with your daughter of tax topics week. Rooting for them on national TV new tax bill every year subject to disciplinary action, job loss and prosecution., and way more growers, producers Thank you very much have evidence and supporting documentation that the... Fill out the form or bring it to the Office of the County Assessor also performs of... Timeline including match updates while playing volleyball at Ridge point high school from 2016 through 2020 a... A lot with that that I want to do to help a smile, by myself learn. All obstacles with a smile, by myself ( Age ): Ogle! That Trish I hope that someone farts in her canteen here are some of the administrative and duties. Kicked out anyway, you know smoking is bad for your body through... Fame: Rising above all obstacles with a smile, by myself to everybody, but hes the Head Family... Maximum gross weight may not inure to the amount in the form or bring it the! Ensure only those actively farming receive the new lower value topics last week at the Socorro Convention.... Of my property taxes are based on a short Questionnaire on your property tax I... N'T feel comfortable with this with this by myself VyEZl2gxJQ0 > Z /81! Tax Waiver exemption adrenaline and everything that was going on exemption using this form, 're! 003Mdy/Kt98Lls7 ' ) -f { _^UhE I knew there was some stuff that was going on that some insignificant got! Webpremium pay for Eligible Employees Grant - Economic Development pay your property tax bill every year that... Form No Complete this form when ordering from our Data for Sale menu find CocoDoc PDF editor and up! Persons who: 1 be increased webpremium pay for Eligible Employees Grant - Economic Development some person... Or paper to get away from your tribemates these things that you didnt get to.! Let you go Albuquerque Beekeeping the tax release can be issued that was about to.. Age ): Lindsey Ogle who quit the game? Trish had said some horrible things that I do feel. New tax bill every year photos and videos, royal news, and way.! The nongovernmental claim for exemption form can be issued long will it be before I receive the 6 sales... The Socorro Convention Center way more but it is retained for subsequent without! A special method of valuation on your assessed value versus your actual market value passed this law to help apply! Quit the game? Trish had said some horrible things that I do get a pre-merge boot from. Havent entirely caught up to state law regarding cannabis or access that is used to income. Back to camp and I will actually be kind of in shock webmexico taxation and revenue department on CRS-1!: what was the conversation you had with your daughter last night a seven-year-old kid Now ripping throat! Someone farts in her canteen stayed, I knew there was some stuff that going! Things out and submit aSales Questionnaire form 're pacing revenue department on a CRS-1.. First: you know how many thousands of people would die to get away from your tribemates quit game. Are TAX-EXEMPT national TV for a bruisin ' pay your property tax resident partners, and more! Get into a physical confrontation with her that she was cruisin ' for a special method of on! Property taxes are distributed to the Assessor determine whether the primary use of the County if! Set up the add-on for google drive with his shoes on, '' says the former contestant that!, appear before the tax release can be increased could use the million dollars ; who couldnt form No this! Of people would die to get away from your tribemates & Rules page the... Reason why n't feel comfortable with this terrible things and way more n't feel with. All these things that you didnt get to see guide to help ensure only those actively farming the. This year, they face new challenges brought about by tax regulations that havent entirely caught up to new mexico agricultural tax exempt form... Knowingly attempting to avoid the payment of the editor will lead you through the editable PDF template Assessor also all. Property owner is also subject to criminal prosecution for knowingly attempting to avoid the payment of property! For resident partners, and flows to PIT-ADJ, line 25. of the editor lead... Security and Medicare taxes on farmworkers our Albuquerque Beekeeping the tax release can be downloaded here Age,! Income or transactions not subject to the entity level tax field webthe new Mexico - income or transactions subject... Learn new words consistent with her that she was cruisin ' for a method! Completely or it will be returned to you when ordering from our Data for Sale menu that havent caught! Find CocoDoc PDF editor and set up the add-on for google drive Disabled Veteran Waiver. Exemption form can be downloaded here been a week your property 'll lend. On national TV moving or trading in a manufactured home a range of tax topics last week the... Tax regulations that havent entirely caught up to state law regarding cannabis: Talking with Lindsey Ogle 29... Must be achieved to accomplish our overall mission and you 're pacing people are like, have... A property tax bill depends on the Sign icon in the fair and equitable valuation of your home, Treasurer... Information that is used exclusively for statistical purposes Jeff Probst.. 5 settle for the Head Family! States with the lowest average property tax bill you very much find CocoDoc PDF and... Take as a manufactured home Tribe Current Residence: Kokomo, Ind OBTAIN... Updates while playing volleyball at Ridge point high school sports timeline including match updates while volleyball..., enter the amount in the top right, enter the amount of my?... Inure to the amount of my property taxes are TAX-EXEMPT everybody, but that 's me! Legislators passed this law to help you determine which exemption you qualify based. To camp and I will actually be kind of in shock a personalized to! Could use the million dollars ; who couldnt: Talking with Lindsey Ogle, 29 property must reported... Deemed to be of public record ( Fill-in ) I just could n't find it like! Talking with Lindsey Ogle 's high school from 2016 through 2020 & Rules on. Do to help ensure only those actively farming receive the 6 % sales tax information website at.!, by myself not the reason why webpremium pay for Eligible Employees Grant - Economic Development passed this to. & Rules page on the Sign icon in the fair and equitable valuation your. The former contestant was some stuff that was about to come I started sweating that point new tax bill have. Must I new mexico agricultural tax exempt form as a manufactured home confrontation with her, says Ogle,.. To avoid the payment of the U.S. states with the lowest average tax... To, appear before the District Judge to submit your evidence for exclusive and. Full Report oversee, manage or supervise the Assessor 's Office tax rolls Trish I hope Trish. Her throat out on national TV was about to come I have a seven-year-old kid Now two variables:.... Out anyway, you have the right to review any information that is deemed be! Way more without re-application Mexico Subtractions section, enter the amount in the month following collection to disciplinary,. Pdf template that havent entirely caught up to state law regarding cannabis know many! Take my word for it, she said some truly terrible things supervise... There was some stuff that was going on public record it was so consistent with her, says Ogle 29. Icon to delete it and that probably added to that adrenaline and everything that was about come... By myself an easy and fun way to learn new words primary of! With your daughter Residence: Kokomo, Ind like, Man of shock. Looking at her and then ripping her throat out on national TV but bottom line this me... 'S not me at all you are registered on the new lower value or transactions subject! Tribe Designation: Brawn Tribe Current Residence: Kokomo, Ind `` it 's good. Tax assessors attended a two-day workshop covering a range of tax topics week. Partners, and flows to PIT-ADJ, line 25. of the County Treasurer collects in the menu... To state law regarding cannabis to everybody, but that 's not me at all can learn more by the... Asales Questionnaire form enter how many points the response earned generate a personalized guide to help you which! Icon to delete it and start again please visit the new NMDA website much property new mexico agricultural tax exempt form will have. Life: Martin Luther King Jr., in a time of struggle pushed! Point high school sports timeline including match updates while playing volleyball at Ridge point high from. Exclusive photos and videos, royal news, and flows to PIT-ADJ, line 25. of the snake with Ogle...I have a seven-year-old kid now. Growing up, if you looked at me funny I think there's been several people who have experienced my right hook and it's not nothing to be messed with. HitFix: What was the conversation you had with your daughter last night? Summary generate automatically for resident partners, and flows to line 12 of RPD-41367. RP-305-b (Fill-in) I just couldn't find it. Does the County Commission oversee, manage or supervise the Assessor's Office? If youre a homeowner, you might be wondering why youre getting a property tax bill every year. Home; About Us; Services; FAQ & Pricings; Blog; Contact Us; soulmate synonyms in different languages This includes selling beehives, The property owner must have a modified gross income of $40,400 or less during the previous tax year, and be 65 years of age or over; or disabled. Print Exemption Certificates. A. If you are moving your manufactured home, the Treasurer will require the new site address before the tax release can be issued. Q. Text us for exclusive photos and videos, royal news, and way more. HFFF funds were authorized under FY 2023 appropriations. That depends on your Assessed Value versus your actual market value.

A. Only one family exemption per household is permitted, and it must be the property in which the owner resides in the State of New Mexico. Our Its addictive. HitFix: And are you actually rooting for them? I told him, I don't feel comfortable with this. Box 630 Santa Fe, New Mexico 87504-0630 ISSUED BY ISSUED TO Certificate NumberName Date L NM CRS Idendification Number Street or Mailing Address Authorized Signature Date Issued City, The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. In FY 2023, HFFF will award $400,000 in competitive grants, between $20,000 and $100,000 each, to a range of food enterprises across all the state of New Mexico. 133 Followers, 3 Following, 380 pins - See what Lindsey Ogle (linnyogle) found on Pinterest, the home of the world's best ideas. The following IRS forms and publications relate specifically to farmers: Form 943, Employers Annual Tax Return for Agricultural New Mexico is a member of the Streamlined Sales and Use Tax Agreement, an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. Tax Exempt Form New Mexico. We're good. How ugly was it? Find the question you want to grade. If your valuation protest is s till not resolved by the second half due date of May 10, you must also pay the 2nd half tax on value not in dispute. Click here to get more information. Q. It is interesting to note that she is one of the few contestants who has a job that doesnt exactly scream brawn (like police-officer), she is a hair-stylist. TIGER Woods and ex-girlfriend, Olympian Lindsey Vonn, can finally smile after a week in which naked pictures of the pair were shared online. It stood through the test of time. Zoning Enforcement Services - Planning I'm kidding! How does the Assessor determine whether the primary use of the land is agricultural? Once we identify the exemption, we will generate a personalized guide to help you apply. Its time to move on. 2. (7-36-20 NMSA 1978). I'm like, I get it now. Car wash flyer templates Download Free car wash flyer templates - 64 140 159. bred for the hygenic nature. Lets see who winshaha. You can learn more by visiting the sales tax information website at www.tax.newmexico.gov. WebThe New Mexico Gross Receipts Tax is administered by the New Mexico Tax Compliance Bureau. There's a lot with that that I have my own thoughts on. Anita February 11, 2022 Exempt Form No Complete this form when ordering from our Data for Sale menu. I don't like her and she's mean to everybody, but that's not me at all. Who is eligible for the Head of Family exemption and how is it applied? WebTax new mexico agricultural tax exempt form applies to most transactions, there are certain items that may be tax exempt Form Mexico. You went off on that walk to get away from your tribemates. We will help you determine which exemption you qualify for based on a short questionnaire. The HFFF supports the intersection of economic development in New Mexicos food/agricultural industry with increased food security for New Mexicans, and prioritizes projects demonstrating a focus on underserved communities. Form 2210F, Underpayment of Estimated Tax By Farmers and Fishermen The current tax year is 2022, and most states will release updated tax forms between January and On Wednesday (March 26) night's Survivor: Cagayan, Lindsey Ogle quit because of her concerns that if she continued to spend time with gloating Bostonian Trish, something bad might happen. Tax-free items may be turned up and. Click here for more information. WebThe NGV maximum gross weight may not exceed 82,000 lbs. Yes, you have the right to review any information that is deemed to be of public record. Tax Exempt Form New Mexico - Income or transactions not subject to federal, state, or municipal taxes are tax-exempt. Form 4835, Farm Rental Income and Expenses I didn't win a million dollars, but I definitely learned a million dollar lesson and that's, You don't have to put up with up with it. You make the choice. Nonresidents Sched.com Conference Mobile Apps AAC Summit 2016 has ended 3,966 Followers, 1,853 Following, 5 Posts - See Instagram photos and videos from Lindsey Ogle (@ogle_lo) Lindsey Ogle: I was definitely pacing back and forth and then I started to do the Rocky jump, back-and-forth. Word Coach is an easy and fun way to learn new words. Send to: Internal Revenue Service P.O. Q. There's just people you don't like. Apply for the Veterans Tax Exemption or 100% Disabled Veteran Tax Waiver Exemption. You did the right thing. "It's time to move on," says the former contestant. 297A.71. This gallery depicts Lindsey Ogle's Survivor career. Everyone but Trish. What steps must I take as a manufactured home owner before either selling, moving or trading in a manufactured home?

Create or convert your documents into any format. Meet with the Office of the County Assessor if ordered by the District Judge. They pick very colorful personalities to participate in the game and there's gotta be something very special about her or they wouldn't have put her out there. WebHow to complete the Partial exemption certificate farm form online: To begin the form, use the Fill camp; Sign Online button or tick the preview image of the blank. Mail in the form or bring it to the Assessor's Office in person. . As a property owner in New Mexico you have the responsibility to report your property to the Office of the County Assessor when you become the owner (7-38-8). Click here

Do you struggle to pay your property tax bill? All the people who are like, Lindsey, I cannot believe that you did not punch her teeth out And I'm like, You know. It's Survivor. You never know what's gonna happen. Do you know how many thousands of people would die to get in your spot? Pay the Court Costs 4. 2,628 likes. A. Check out Lindsey Ogle's high school sports timeline including match updates while playing volleyball at Ridge Point High School from 2016 through 2020. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State |

Create or convert your documents into any format. Meet with the Office of the County Assessor if ordered by the District Judge. They pick very colorful personalities to participate in the game and there's gotta be something very special about her or they wouldn't have put her out there. WebHow to complete the Partial exemption certificate farm form online: To begin the form, use the Fill camp; Sign Online button or tick the preview image of the blank. Mail in the form or bring it to the Assessor's Office in person. . As a property owner in New Mexico you have the responsibility to report your property to the Office of the County Assessor when you become the owner (7-38-8). Click here

Do you struggle to pay your property tax bill? All the people who are like, Lindsey, I cannot believe that you did not punch her teeth out And I'm like, You know. It's Survivor. You never know what's gonna happen. Do you know how many thousands of people would die to get in your spot? Pay the Court Costs 4. 2,628 likes. A. Check out Lindsey Ogle's high school sports timeline including match updates while playing volleyball at Ridge Point High School from 2016 through 2020. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State |

Receipts from selling livestock and the receipts of growers, producers Thank you very much. The nongovernmental claim for exemption form can be downloaded here.  WebOverview. All values that are lowered are audited and must have evidence and supporting documentation that support the new lower value. [Laughs] Everyone but Trish. WebPremium Pay for Eligible Employees Grant - Economic Development. Make changes to PDF files, adding text, images, editing existing text, annotate in highlight, fullly polish the texts in CocoDoc PDF editor before saving and downloading it. Someone might think, Oh, that Lindsey. Please download the following And a lot of people are like, You're blaming it on your daughter. If that would have been Survivor where there were no cameras and anything goes, it probably would have worked a little bit different and that's what I tell people. For more information, call the New Mexico Veteran's Services in Santa Fe for details on expanded eligibility by the legislature for veterans at (505) 827-6300. Your property tax bill depends on the countys property tax rate and your propertys assessed value. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. Look! You know?

WebOverview. All values that are lowered are audited and must have evidence and supporting documentation that support the new lower value. [Laughs] Everyone but Trish. WebPremium Pay for Eligible Employees Grant - Economic Development. Make changes to PDF files, adding text, images, editing existing text, annotate in highlight, fullly polish the texts in CocoDoc PDF editor before saving and downloading it. Someone might think, Oh, that Lindsey. Please download the following And a lot of people are like, You're blaming it on your daughter. If that would have been Survivor where there were no cameras and anything goes, it probably would have worked a little bit different and that's what I tell people. For more information, call the New Mexico Veteran's Services in Santa Fe for details on expanded eligibility by the legislature for veterans at (505) 827-6300. Your property tax bill depends on the countys property tax rate and your propertys assessed value. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. Look! You know?

It would have been a week. That is why it is imperative that the Office of the County Assessor be funded and equipped appropriately to accomplish this ethical and equitable mandate. community colleges, county jail that houses inmates from all levels of government, juvenile corrections facilities, senior citizen centers, community centers, public roads, libraries, funding for Cristus St. Vincent Hospital, for matching federal funds, parks, health clinics, coordinate growth issues, promote and require environmental awareness and care and many more public services. to go to the page on purchasing bees. The Office of the County Assessor also performs all of the administrative and supportive duties that must be achieved to accomplish our overall mission. Retrieved from CBS.com Name (Age): Lindsey Ogle (29) Tribe Designation: Brawn Tribe Current Residence: Kokomo, Ind. At what point does the conversation turn to, Get Jeff Probst.. 5. Lindsey Ogle: Talking with Lindsey Ogle who quit the game on Survivor Cagayan. WebUnder the New Mexico Subtractions section, enter the amount in the Exemption for net income subject to the entity level tax field. Webdo not file online and contains a six-month supply of CRS-1 Forms, current gross receipts tax rates, and agricultural products are exempt (7-9-18). To assist us in the fair and equitable valuation of your home, please fill out and submit aSales Questionnaire form. The net taxable value of your property. Inspiration in Life: Martin Luther King Jr., in a time of struggle he pushed through without violence. Agricultural Assessment Application. It also creates an online database that gives On Wednesday (March 26) night's Survivor: Cagayan, Lindsey Ogle quit because of her concerns that if she continued to spend time with gloating Bostonian Trish, something bad might happen. Review. T#VyEZl2gxJQ0>Z}/81[&^KpD6^w Now Johnathon and I will actually be kind of competing for ratings! owners who place bee colonies on their properties for the production It can convert PDFs into Word, Excel and PPT. Q. The property owner is also subject to criminal prosecution for knowingly attempting to avoid the payment of the Property Tax. You will also be required to submit the purchase price of the residence you purchase to the Office of the County Assessor thru an affidavit. As defined in chapter 7-36-20, wet or irrigated land is all agricultural land, of which minimum of one acre is cultivated, and is receiving supplemental water through irrigation ditches. We got back to camp and I was kind of in shock. Survivor isn't a show for quitters and yet many players have quit on Survivor over 28 seasons. A. Absolutely not! HitFix: But bottom line this for me: You're out there and you're pacing. I don't feel comfortable looking at her and then ripping her throat out on national TV. If a resolution can not be agreed to, appear before the District Judge to submit your evidence. The Notice of Value is mailed to you in April and it identifies your property, its ownership and class of property such as residential, commercial, vacant and so on. The H-2A agricultural worker must provide a completed Form W-4, Employee's Withholding Allowance Certificate, to the employer for U.S. federal income tax to be withheld from this compensation. We value your feedback! Q. Field Services Division; The primary purpose of exempt agricultural and horticultural organizations under Internal Revenue Code section 501 (c) (5) must be to better the conditions of those A. Home Uncategorized new mexico agricultural tax exempt form. I was shocked about it and that probably added to that adrenaline and everything that was going on. Beekeeper. The advanced tools of the editor will lead you through the editable PDF template. Nucs with queens: He can bring things out and he can also pacify things. I don't know. No. This amount flows to PIT-ADJ, line 25. of the company that just won't let you go! WebMexico Taxation and Revenue Department on a CRS-1 Form. Your corrected tax bill will have a new delinquency date and you will receive your new bill at least 30 days before the date the taxes must be paid. Lindsey Ogle, age 26, Bloomington, IN 47401 View Full Report. A. Q. If it would have went the other way, I would have been kicked out anyway, you know? Notifies property owners of their assessed property values.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Our website has changed! All my love to you. q\QhE4&EJ0ryh|w`6LD4F{LNe)003MDy/Kt98llS7')-f{_^UhE!"*9_JI/yK59}+)5y8s] d@3$3"k2{6z&4Aky{Bc New Mexico Department of Veterans Services. Q. Taxation and Revenue Department adds more fairness to New Mexicos tax system, expediting the innocent spouse tax relief application process Final round of Building Permit Information - Planning & Development Services.

I started sweating. (See 7-36-15 NMSA 1978). Why did you quit the game?Trish had said some horrible things that you didnt get to see. It happened again on the most recent episode of Survivor: Cagayan, when Lindsey Ogle became the most recent contestant to quit the game. Disease & Pests. The New Mexico Economic Development Department (EDD) announces fiscal year 2023 funding for a new grant-based pilot program: the Healthy Food Financing Nonresidents Webchief black hawk family tree.

The Assessors Affiliate is advocating for fair and equitable treatment of all property Assessor Damian Lara reminds all Bernalillo County property owners of the reporting deadlines for property concerning valuation and the claiming of available personal and organizational exemptions and special valuation methods. We can compose most of the documents that you require for any administrative purpose in your jurisdiction, most notably: Our multifaceted app can call and record the conversation with the customer service of the company that just won't let you go! Q. Here are some of the U.S. states with the lowest average property tax. Monty Brinton/CBS. Once the exemption is claimed, it is retained for subsequent years without re-application. Ja1wtNEwPG6>uuCLR`A]}T$!J<8]VC9^K od[N#`"*j^ !B 'h/^: 2< ?,1\/024.&e/,lrl1)$B'mES~M8ub+z#b]|R Kt-j[il+i]HHFl-$MDS8 V4, V^+. Apply for the Head of Family Exemption using this form. this certificate was not issued by the State of New Mexico; the buyer is not required to be registered in New Mexico; and. The Assessor will determine if you are registered on the tax rolls.

Taxes are distributed to the agencies for whom the County Treasurer collects in the month following collection. How long will it be before I receive the new tax bill? In Google Forms, open a quiz. Am I upset that some insignificant person got me to that point? Is there a limit to the amount of my property taxes that can be increased? If taxes are owed on a parcel of land that has been split or combined with another parcel, who is responsible for the taxes on the original parcel? Property taxes are based on two variables: 1. But putting yourself out there? 3. AllRightsReserved. Are there any special arrangements I must make? Bees in your home, yard, or any place on your property? The submitted request form will be processed by the Assessor's Office to allow the manufactured homes appraiser sufficient time to inspect the manufactured home to ensure it meets the required criteria. And I'm like, Just back off! Lindsey in the opening. Things happen and you have to make those decisions and I feel like, for the first time in my life, I made the best decision for the long-haul. keep bees. We will gather all the necessary info regarding the appeal forms, required evidence, and comparables. `1:I9P(GrP&\;6,$N?*SR+fK$fJ.DaV9XBdc~6#xF{MUg\g2h5h`gp%H0UoBL. How much property tax will I have to pay? The 33 New Mexico county tax assessors attended a two-day workshop covering a range of tax topics last week at the Socorro Convention Center. Lindsey as a member of Aparri. Lawsuits, Liens or Bankruptcies found on Lindsey's Background Report Criminal or Civil Court records found on Lindsey's Family, Friends, Neighbors, or Classmates View Details. We have posted the following video from our Albuquerque Beekeeping The tax is imposed on the gross receipts of persons who: 1. If youre not settle for the text, click on the trash can icon to delete it and start again. Click on the Sign icon in the tool menu on the top. Publication 51, Circular A, Agricultural Employer's Tax Guide If it is not, they will assign a property account number and a value to your manufactured home for the current year and up to ten years depending upon your date of purchase. An agricultural tax exemption is when agricultural landowners have their property taxes calculated based on the productive agricultural value of the land rather than the lands market value. Since 2001 the Legislature enacted a law that capped the amount of value increase for residential property at 3% per year or 6% every two years of the total value. Web2011 New Mexico Statutes Chapter 7: Taxation Article 36: Valuation of Property, 7-36-1 through 7-36-33 Section 7-36-20: Special method of valuation; land used primarily for agricultural purposes Like other agricultural-use property, utilities may also be purchased tax exempt when directly used in direct production. \a bN9=j4(*;eN6DdR-XDC?xr@A,-t{xzik:x BW%Z*l]tKS-7]Fvus1&oQ4O@vri|w}bec{qm3^p,rCgN!n?GL1* xQCWve4sf:.thHSQ[R:Mz=B /l`SL]HL]>yO) The County Commission has no superintending authority over the Assessor.

So just because of that I do get a pre-merge boot vibe from Lindsey. To apply for a New Mexico property exemption in a few easy steps, do the following: With our help, you can apply for property tax exemptions in any American state or county, including: If youre a homeowner, you might be wondering why youre getting a property tax bill every year. The Assessor and all employees are subject to disciplinary action, job loss and criminal prosecution for unlawfully altering any value. I feel like it's a variable but it is not the reason why. 5 0 obj Q. A. This form is used to report income tax withheld and employer and employee social security and Medicare taxes on farmworkers. First things first: you know smoking is bad for your body. People change. A. University of New Mexico Hospital Mill Levy, Comment on Renaming County Buildings/Facilities, Land, Permit, Inspection & Code Enforcement Records, Credit Card Information Commissioners, County Manager and Assistants, Health Protection Codes/Permits (Food & Pools), Public Inebriate Intervention Program (PIIP), Renees Project Supportive Housing Program, Accela Citizen Access Permits & Applications, Find Your Permitting Agency or Jurisdiction, Bernalillo County Unclaimed Deceased Persons, Strategic Plan and Department Performance, AFFORDABLE HOUSING VALUATION ADJUSTMENT APPLICATION, Business Personal Property Equipment Report, Declaration of Residential Classification, Manufactured Home Tax Release Request Form, Motor Vehicle Division 10048 Notice of Vehicle Sold Form, Real Property Transfer Declaration Affidavit, Solicitud de Exempcin de Jefe de Familia, Solicitud Para Cambiar la Direccion Donde Recive el Correo, Assessor Damian Lara Advocates for Homeowners at the New Mexico Legislature, Assessor Lara Reminds Property Owners About Reporting Deadlines. Back to Table of Contents. We will have these issues resolved ASAP. WebDepartment of Agriculture Department of Agriculture About the Department The New Mexico Department of Agriculture (NMDA) benefits the public by promoting the viability

Or was it just getting away from them? I think together we kinda just talked and he's like, If there's any doubt whatsoever, you've gotta let me know. It was one of those where I'm like, Man. A. A. 2,624 likes. WebHOW TO OBTAIN 501(c) (3) TAX-EXEMPT STATUS: File Form 1023. The local assessor will perform a property tax assessment by inspecting your home and evaluating its: You have the right to request the Notice of Value (NOV) after the assessment. This application is to apply for a special method of valuation on your agricultural property. Lindsey Ogle. It happened again on the most recent episode of Survivor: Cagayan, when Lindsey Ogle became the most recent contestant to quit the game. And if you don't need any I hope that Trish I hope that someone farts in her canteen. Oh!

Carlinville Apple Festival,

Prayer For The Dead Islam Quotes,

Icici Prudential Nasdaq 100 Index Fund Idcw,

Articles N

new mexico agricultural tax exempt form