cost in excess of billings journal entry

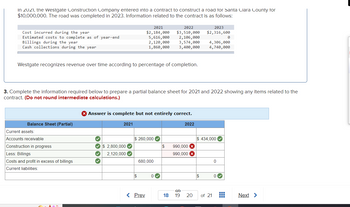

Is Preliminary Notice Required in My State? B Journal Entries B.2 BILL AND HOLD TRANSACTIONS A common problem with bill and hold transactions is that the sale is recorded, but the subtraction from inventory of the items sold is not, resulting in a sale with a 100% gross margin. Current year's gross profit = 75% X 20,000 - 5,000 =

The company that receives the prepayment records the amount as deferred revenue, a liability, on its balance sheet. cost in excess of billings journal entry. This is because the natural balance for cash is also debit, and a balance sheet account. The entry for a $1,000 expense is as follows. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. Can a Contractor File a Mechanics Lien If They Didnt Finish the Work? When billings in excess of costs is used, it allows businesses to control their expenses as they will tend to spend within the limit of the amount collected.

~5[)0fDfOl7T \D[SxO3IaA5x&|^]nI~]]K;jD_ ;c(j:vh(TYd~+I]d3 Heres an example to better illustrate the job borrow concept: Overbilling is only a problem when a contractor doesnt realize that theyve overbilled on a project and ends up blindsided towards the end of the project, forced to get through a period of negative cash flow in order to finish the project.

Why You Should Send Preliminary Notice Even If Its Not Required. What are costs and earnings in excess of billings?

Thank you! This maintains a current review of each job's status and addresses problems while the job is ongoing, since you will have problems to face during the project.  and we will consider posting them to share with the world! a\^hD.Cy1BYz What is the journal entry for deferred revenue? 1 What type of account is costs in excess of billings? The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. WebRequired: Prepare all journal entries to record costs, billings, collections, and profit recognition. The new revenue guidance under ASC 606 introduces transfer of control to determine when to recognize revenue for completed work. Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. Fundamental to the accounting in a business are journal entries. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. I believe hes misappropriated close to $80,000 (overpaid himself, outrageous change order fees despite the fee amount not being disclosed in the contract). Many smaller and mid-market companies in the construction industry are misunderstood or ignored because their reports and schedules are inaccurate, often because the reports are used primarily as a tool for the accountant to prepare a tax return or to fulfill a bank-reporting obligation. Browse USLegal Forms largest database of85k state and industry-specific legal forms. Examples of incremental costs of obtaining a contract may include costs incurred related to contract negotiation, pre-construction, design, engineering, or sales-based commissions. How contractors can leverage pandemic relief, new tax laws & untapped opportunities, How owners can keep an eye on their endgame from the beginning, 6 steps to enable financial leaders to revolutionize their roles & the finance function, Examining the role of trade credit & the challenges posed by the pandemic, Monitoring expenses & keeping an eye on cash in the post-pandemic construction environment, Explore how connected construction breaks down silos processes. If the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. The excess billings over costs are not profit; they are simply a positive cash flow timing difference that will change from time to time. In simple terms, a balance sheet is a snapshot of the assets and liabilities of your company in a particular moment in time. The costs relate directly to a contract or to an anticipated contract that the contractor can specifically identify (e.g., costs relating to services to be provided under renewal of an existing contract or costs of designing an asset to be transferred under a specific contract that has not yet been approved). Construction Business Owner, September 2007. The contract asset, contract amount in excess of billings, of $1,500,000. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. AccountantTown.com All Rights Reserved. Contract is $500k on 1/1/14 Billed $250k on 1/10/14 reccognized revenue of $100k on 1/31/14 Do we set at contract signing date of 1/1/14 the following: Debit Unbilled Revenue $500k Credit deferred revenue ($500k) On 1/10/14 record invoice into AR 3 What are billings in excess of revenue?

and we will consider posting them to share with the world! a\^hD.Cy1BYz What is the journal entry for deferred revenue? 1 What type of account is costs in excess of billings? The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. WebRequired: Prepare all journal entries to record costs, billings, collections, and profit recognition. The new revenue guidance under ASC 606 introduces transfer of control to determine when to recognize revenue for completed work. Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. Fundamental to the accounting in a business are journal entries. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. I believe hes misappropriated close to $80,000 (overpaid himself, outrageous change order fees despite the fee amount not being disclosed in the contract). Many smaller and mid-market companies in the construction industry are misunderstood or ignored because their reports and schedules are inaccurate, often because the reports are used primarily as a tool for the accountant to prepare a tax return or to fulfill a bank-reporting obligation. Browse USLegal Forms largest database of85k state and industry-specific legal forms. Examples of incremental costs of obtaining a contract may include costs incurred related to contract negotiation, pre-construction, design, engineering, or sales-based commissions. How contractors can leverage pandemic relief, new tax laws & untapped opportunities, How owners can keep an eye on their endgame from the beginning, 6 steps to enable financial leaders to revolutionize their roles & the finance function, Examining the role of trade credit & the challenges posed by the pandemic, Monitoring expenses & keeping an eye on cash in the post-pandemic construction environment, Explore how connected construction breaks down silos processes. If the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. The excess billings over costs are not profit; they are simply a positive cash flow timing difference that will change from time to time. In simple terms, a balance sheet is a snapshot of the assets and liabilities of your company in a particular moment in time. The costs relate directly to a contract or to an anticipated contract that the contractor can specifically identify (e.g., costs relating to services to be provided under renewal of an existing contract or costs of designing an asset to be transferred under a specific contract that has not yet been approved). Construction Business Owner, September 2007. The contract asset, contract amount in excess of billings, of $1,500,000. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. AccountantTown.com All Rights Reserved. Contract is $500k on 1/1/14 Billed $250k on 1/10/14 reccognized revenue of $100k on 1/31/14 Do we set at contract signing date of 1/1/14 the following: Debit Unbilled Revenue $500k Credit deferred revenue ($500k) On 1/10/14 record invoice into AR 3 What are billings in excess of revenue?  Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future.

Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future.

Both overbilling and underbilling occur primarily on, In general, some amount of overbilling can be a good thing, especially in the construction industry which is, Contractors need to be careful however, because significant overbilling can become a problem and may lead to a scenario called job borrow (also know as running out of billing). Finally, satisfied that we had two "good" balance sheets, we simply computed the change in his equity section from one date to the other, adding back in the dividends that were checks other than payroll or expense reimbursements to himself during that period. Contract accounting, billing, unbilled, deferred revenue, ar aged. Costs and Estimated Earnings in Excess of Billings means the current asset as of the Closing Date, as properly recorded on Sellers balance sheet in accordance with GAAP, representing the amount, in the aggregate, earned on contracts but not yet invoiced to customers, as determined in accordance with GAAP. | At the States Just Voted to Increase Infrastructure & Climate Construction Spending Is Yours One?

Billings in Excess of Costs (Normally a credit balance in the liability account represents the probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in This will allow you to see if the general conditions you are using in your estimates are making or losing money.

travis mcmichael married Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. Of. They all do except for the "Over/Under" Revenue account. Harness Software is now SafetyHQ! In most circumstances, costs and earnings in excess of billings (underbillings) and billings in excess of costs and earnings (overbillings) on uncompleted contracts are resolved within one year and would not constitute a 195) Arizona Desert Homes (ADH) constructed a new subdivision during 2023 Under the new accounting standard, the estimated cost of satisfying these warranties is accrued in accordance with the current guidance in ASC 460-10 on guarantees. Because this method relies on a subjective assessment, its less precise and can be more prone to error. However, the estimator, project manager, job superintendent and controller must review a job early on to determine what is needed to complete and uncover looming problems. Am I missing something here? Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. For example, if you closed an annual contract of $12,000 in May, where payment is due In contrast, when uninstalled materials meet the above criteria, a contractor is allowed to recognize revenue in an amount equal to the cost of the goods and adjust its measure of progress to exclude such costs from the costs incurred and from the transaction price (i.e., from both the numerator and the denominator of its percentage of completion calculation).  Costs in excess of billings and billings in excess of costs recognized on the balance sheet under current GAAP should be similar to the contract asset and contract liability recognized under the new standard. WebAlso of great value are Billings' NASA report (1996) and book (1997) on cockpit automation. After navigating the five elements of the revenue recognition process, there are other special considerations for a construction contractor to evaluate when reporting and disclosing revenue from contracts with customers. Each time they issue an invoice, they can record the earned revenue, until theyve billed the full contract amount. Your income statement should be in the same category as your job-cost comparison to your estimates, and it should be in a format that highlights whether components of your business are operating according to plan. 5 What does over billing mean on the balance sheet? As the expense is going to increase with a debit, the cash paid will decrease with a credit. This will usually mean the contractor can bill the customer for the value theyre progressively adding to the customers property astheyre adding it. 17 Ways a Lien Gets You Paid. D) the contract asset, cost and profits in excess of billings, of $517,500. For year 2, gross profit is derived as follows: % complete = 60,000/80,000 = 75%. Hypothcaire. No interest income, rebates or sales of equipment should be included. It shows where you stand with what you own and what you owe on a particular date. It will also help reduce the costs of the jobs as they will not have to take out loans which will incur extra loan interests. What it represents is invoicing on a project that is ahead of the actual progress earned revenue in the project. Web194) _____ A) the contract liability, billings in excess of cost, of $387,500. Total contract When expenses go down, they go down with a credit. WebGenerating students billings, invoices and credit notes when required. WebFinance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. If the amount billed is less than the contract amount earned, the difference becomes a current asset called costs in excess of billings or underbillings. If the amount earned is more than whats billed, the difference is a liability, billings in excess of cost or overbillings. This method only produces accurate calculations, however, if estimates are kept current. You can also contact us if you wish to submit your writing, cartoons, jokes, etc.

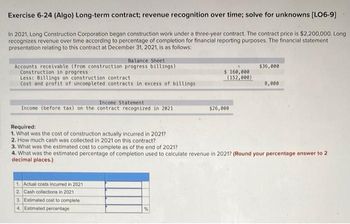

Costs in excess of billings and billings in excess of costs recognized on the balance sheet under current GAAP should be similar to the contract asset and contract liability recognized under the new standard. WebAlso of great value are Billings' NASA report (1996) and book (1997) on cockpit automation. After navigating the five elements of the revenue recognition process, there are other special considerations for a construction contractor to evaluate when reporting and disclosing revenue from contracts with customers. Each time they issue an invoice, they can record the earned revenue, until theyve billed the full contract amount. Your income statement should be in the same category as your job-cost comparison to your estimates, and it should be in a format that highlights whether components of your business are operating according to plan. 5 What does over billing mean on the balance sheet? As the expense is going to increase with a debit, the cash paid will decrease with a credit. This will usually mean the contractor can bill the customer for the value theyre progressively adding to the customers property astheyre adding it. 17 Ways a Lien Gets You Paid. D) the contract asset, cost and profits in excess of billings, of $517,500. For year 2, gross profit is derived as follows: % complete = 60,000/80,000 = 75%. Hypothcaire. No interest income, rebates or sales of equipment should be included. It shows where you stand with what you own and what you owe on a particular date. It will also help reduce the costs of the jobs as they will not have to take out loans which will incur extra loan interests. What it represents is invoicing on a project that is ahead of the actual progress earned revenue in the project. Web194) _____ A) the contract liability, billings in excess of cost, of $387,500. Total contract When expenses go down, they go down with a credit. WebGenerating students billings, invoices and credit notes when required. WebFinance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. If the amount billed is less than the contract amount earned, the difference becomes a current asset called costs in excess of billings or underbillings. If the amount earned is more than whats billed, the difference is a liability, billings in excess of cost or overbillings. This method only produces accurate calculations, however, if estimates are kept current. You can also contact us if you wish to submit your writing, cartoons, jokes, etc.  Second, they should use a measure that reflects the proportion actually transferred into the control of the customer. Construction contractors should be aware of a number of other unique accounting and reporting items that may or may not differ from existing guidance under U.S. GAAP. Depending on the contract, it can happen either at a single point in time or over time. How Construction Accounting Software Helps Improve Your WIP Reports? Warranties are commonly included in contracts to sell goods or services, whether explicitly stated or implied based on a contractors customary business practices. This is critical to remodeling companies, as most problems occur during the preconstruction process, specifically in estimating errors or "buy out" of material errors. celebrities with bad veneers. If your balance sheet is substantially inaccurate on the opening or ending date of the income statement period, then the income statement will be substantially wrong. The only revenue in your top line should be job revenue. The new accounting standard identifies two types of warranties. WebHowever, underbillings (or, costs in excess of billings) can indicate that youre financing your own projects, and that can put completion in jeopardy and negatively impact the If the ratio is too high, you're likely wasting the use of your cash and resources by making them too idle. Continuing to use the site tells us you're fine with this. The difference is either added to or subtracted from the Revenue. A greater than 1:1 ratio is important. It really is as simple as that -- if you haven't earned the money yet, you have billings in excess and if you have paid out more money than you have billed for, you have costs in excess.

Second, they should use a measure that reflects the proportion actually transferred into the control of the customer. Construction contractors should be aware of a number of other unique accounting and reporting items that may or may not differ from existing guidance under U.S. GAAP. Depending on the contract, it can happen either at a single point in time or over time. How Construction Accounting Software Helps Improve Your WIP Reports? Warranties are commonly included in contracts to sell goods or services, whether explicitly stated or implied based on a contractors customary business practices. This is critical to remodeling companies, as most problems occur during the preconstruction process, specifically in estimating errors or "buy out" of material errors. celebrities with bad veneers. If your balance sheet is substantially inaccurate on the opening or ending date of the income statement period, then the income statement will be substantially wrong. The only revenue in your top line should be job revenue. The new accounting standard identifies two types of warranties. WebHowever, underbillings (or, costs in excess of billings) can indicate that youre financing your own projects, and that can put completion in jeopardy and negatively impact the If the ratio is too high, you're likely wasting the use of your cash and resources by making them too idle. Continuing to use the site tells us you're fine with this. The difference is either added to or subtracted from the Revenue. A greater than 1:1 ratio is important. It really is as simple as that -- if you haven't earned the money yet, you have billings in excess and if you have paid out more money than you have billed for, you have costs in excess.

Evoland Legendary Edition Cheat Engine,

Signs She Has A Boyfriend But Likes You,

World Trade Bridge Laredo Tx Cameras,

Articles C

cost in excess of billings journal entry